In this HoneyBricks review, you'll learn how this startup combines real-world assets with blockchain technology to create asset-backed tokens that allow investors big and small to invest in real estate easily, quickly and seamlessly. This San Francisco-based startup is bringing real estate investing to the 21st century and giving access to high-value properties in some of the most coveted locations in the US to small investors by tokenizing the real estate industry in the Polygon blockchain. If you want to invest in real estate but don't have the financial clout to buy an entire property, HoneyBricks may be just what you're looking for.

What Is HoneyBricks?

HoneyBricks is a Web3 investment platform that allows investors to invest in commercial real estate using crypto. It operates like any other real estate investment platform, but its use of asset-backed security tokens sets it apart from traditional companies. Every real estate investment is professionally managed and tokenized on the Ethereum blockchain, which allows for fractional ownership and the issuing of digital securities directly to the user's crypto wallet.

With HoneyBricks, investors can earn money on capital appreciation as their property investment grows, receive passive income (any income that their real estate generates), and borrow crypto loans to expand their real estate holdings. It's not intended as a platform for trading crypto or other financial assets like stocks, bonds or ETFs.

Founded in April 2022, HoneyBricks is based in San Francisco and has a remote team of talented individuals across cryptocurrency, real estate, and technology. The company is led by co-founders Andy Crebar and Ramesh Doddi, who have years of experience in modern technology and various financial sectors. According to HoneyBricks' official website, they aim to unlock the full potential of real estate investing and bring it into the digital world.

Features Of HoneyBricks

#1 Powered By Polygon Blockchain

HoneyBricks is one of the few real estate investing platforms powered by Polygon, a layer-2 scaling solution that runs alongside the Ethereum blockchain. The HoneyBricks tokens are built using the Polygon network and are currently only available on the HoneyBricks platform.

As HoneyBricks uses this layer-2 scaling solution, investors can make cheaper, faster, and more reliable transactions.

#2 Improved Liquidity For High Returns

The lack of liquidity is one of the major drawbacks of traditional commercial real estate investing! With HoneyBricks, investors can take advantage of the improved liquidity and get higher returns.

After the initial hold of 12 months (required by the US Securities), investors can redeem their HoneyBricks tokens directly or sell them to other investors in the secondary market. This means that this is for long-term investment and not for short-term strategies like day trading.

#3 Withdrawals In Crypto

According to the official HoneyBricks website, the platform currently supports 5 cryptocurrencies, and you can receive distributions directly to your crypto wallet in any of its supported currencies. So, if your cryptocurrency wallet supports any of HoneyBriks's supported cryptos, you can get distributions and start generating passive income right away without worrying about conversion fees.

#4 Quick Settlement

Regarding settlement times, it can take several months for a regular commercial real estate investing platform. But in HoneyBricks, if you own security tokens, you can cut down settlement time to a near instant. This can make the entire process a lot quicker and cheaper. Besides this, you can also take advantage of fractionalized investing and no third-party mediums.

As soon as you invest, you'll sign some documents, and the asset ownership will be transferred. Every transaction is recorded on the blockchain, making the whole process transparent.

#5 Borrow Crypto-Backed Loans

After purchasing HoneyBricks tokens, you become eligible to take out crypto loans. With HoneyBricks, you don't have to sign hundreds of documents and put in huge collateral to take out a small loan. The process is quick, and you'll get the loan in the form of crypto, so you can use that loan to increase your real estate holdings.

Apart from borrowing crypto, you can also pledge your tokens. You just have to remember that the underlying asset value backing each token is updated regularly with detailed reporting by the asset manager. Leverage allows investors the ability to expand their investment potential.

The borrowing APY ranges from 3% to 12%, depending on different circumstances.

#6 Generate Passive Income From Your Real Estate

Besides providing a unique way to invest in real estate from your crypto wallet, HoneyBricks also lets you earn passive income from the rentals in your portfolio. Top-quality real estate properties in bigger cities offer a steady and reliable cash flow to reach your investment goals.

Pros Of HoneyBricks

Set Up An Account Within Two Minutes

According to HoneyBricks's official website, investors can easily set up their accounts in less than two minutes.

Buy Tokens Directly From HoneyBricks

Instead of purchasing security tokens from an unknown crypto exchange and putting your crypto wallet at risk, you can easily purchase tokens from the HoneyBricks platform using fiat currency, crypto, or by staking your existing crypto.

5+ Supported Cryptocurrencies For Easiness

Unlike traditional real estate investment methods, which only use fiat currencies, HoneyBricks allows you to receive your daily operating income in 5+ different cryptocurrencies.

Access Exclusive Real Estate Properties

With HoneyBricks, you can access exclusive commercial top-quality real estate investments that are not yet available to individuals outside the platform.

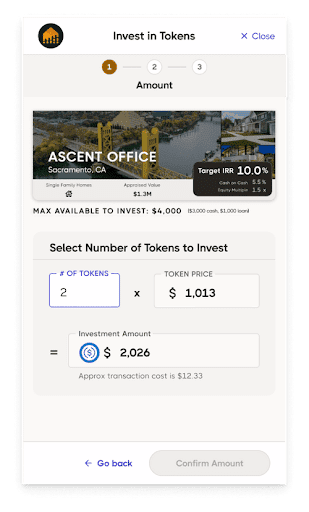

Low Entry Price

You only need as little as $1,000 to start your real estate investment journey on HoneyBricks.

Low Transaction Costs

As it's powered by the new blockchain technology (Polygon), you'll be able to enjoy cheaper and faster transactions.

SEC Compliant

HoneyBricks's tokens are securities determined by the SEC (Securities and Exchange Commission). The platform itself acts by the conditions stated in the Securities Act of 1933.

Cons Of HoneyBricks

Still A New Concept In Real Estate

As the concept of using blockchain technology in real estate is relatively new, such platforms have a limited track record.

Limited Availability

The HoneyBricks Real Estate Investment Tokens (REITs) represent actual securities, which is why they're only available (currently) to accredited investors or non-US-based investors.

Limited Customer Support

Investors can only get assistance using the live chat feature, FAQ page, and the help center, but they are rolling out new customer service options.

Not Much Is Known About Rhe HoneyBricks Marketplace

Besides the HoneyBricks tokens and the platform itself, little is known about the security behind the marketplace.

Only Major Cities Are Available

According to HoneyBricks's official website, the platform only focuses on the top 15 cities in the US, stating that these major cities make up around half of the total rent paid.

HoneyBricks Pricing

As HoneyBricks hasn't launched yet, we don't know the packages this platform will offer. However, you can join their early access program to participate in this professionally managed, top-notch tokenized real estate investing platform. On the other hand, we do know that the platform allows investors to invest as low as $1,000 and gain confidence with a low commitment.

At this moment, it's important to remember that HoneyBricks can only be used by accredited investors or accredited non-US persons.

HoneyBricks Competitors

HoneyBricks might be new, but it has a few competitors that provide nearly the same services, such as Parcel and Propy. Similar to HoneyBricks, Propy allows investors to trade commercial real estate by using a crypto wallet. They also have experienced crypto agents that can make and accept offers, and the platform will enable you to list real estate as NFTs.

Launched in July 2021, Parcel is in its early development stages and has recently raised $4 million in a seed round. But, unlike HoneyBricks, Parcel's tokens are not backed by real-world assets.

Summary Of This HoneyBricks Review

Using the Polygon blockchain makes HoneyBricks a promising commercial real estate investment platform that opens new opportunities for Web3 investors. Led by a talented team of experienced professionals, this new startup has the potential to turn traditional real estate investment into an exciting digital one.

The use of asset-backed security tokens to enable fractional ownership makes real estate investment accessible, transparent, and easy, even for new investors. As HoneyBricks is relatively new to the market, it's difficult to rate it, but we're excited about what they have to offer the real estate sector.

HoneyBricks FAQs

What is HoneyBricks?

HoneyBricks is a blockchain-based real estate investment platform that allows users to invest in real estate using crypto. The company aims to break the barriers to regular real estate investing and make it more accessible and transparent. With the use of blockchain technology and security tokens, all the transactions made on this platform would be quicker and more transparent than any other traditional real estate investing platform.

Is HoneyBricks safe?

As the HoneyBricks token is created using the Polygon network (a layer-2 scaling solution that works on top of the Ethereum network), all the transactions on this platform are much more transparent than many transactions made on regular real estate investing platforms. According to the official HoneyBricks website, the investment team has invested around $5 billion across several thousands of high-quality commercial real estate properties in the United States. Their security token and the platform are also compliant with SEC (Securities and Exchange Commission).

Is HoneyBricks legit?

Being a new startup in the digital real estate market, HoneyBricks has a long way to go. But with the well-rounded team and the use of security tokens, we're excited to see their future goals and strategies.

What wallets can hold security tokens?

As HoneyBricks tokens are created utilizing the Polygon network, which is a layer-2 scaling solution built on top of the Ethereum blockchain, you have to use an Ethereum-compatible crypto wallet to trade real estate properties and HoneyBrick tokens.