GInvest is a digital investment platform that empowers Filipinos to begin their investment journey through its different investment products. With GInvest, you can get started with investing for as little as P50, though we believe GInvest isn't a particularly good way to make money due to its low dividend payout and lack of a standalone app.

If you want to earn a signup bonus, click here to open an account with Kraken, our #1-ranked crypto exchange worldwide. With top-notch security and trading fees below 0.2%, Kraken is an excellent choice for crypto traders anywhere in the world.

Are you in the Philippines and thinking of investing for the first time? The first thing you must do is choose the right broker. But with so many options out there, this can be a daunting task, particularly if you’re unfamiliar with investing. That’s why, in this post, we’ll talk about a popular Filipino investment platform called GInvest, its pros and cons, and a better alternative for most Filipino investors.

What Is GInvest?

GInvest is the Philippines’ first investment platform that operates within the digital wallet GCash. In other words, it’s a platform within a platform that allows users to invest in different types of assets. It was founded in 2019 by Mynt, the same company that launched GCash, which is a partnership between Globe Telecom, Ant Group, Ayala Corporation, and Bow Wave. The company is currently situated in Taguig, Philippines.

The reason behind GInvest’s inception is the lack of opportunities for the common Filipino to explore investing. GInvest started almost four years ago to “…democratize investments and solve a problem for a high-potential, underserved market,” according to Winsely Bangit, the Chief Customer Officer for GCash.

Currently, GInvest only has a single dividend-paying fund which is the AFM Global Multi-Asset Income Fund. This fund invests at least 90% of its assets into a single collective scheme, which includes:

- Equities

- Securities

- Fixed income transferable securities

- Cash

- Deposits

- Money market instruments

As of writing, GInvest only allows investing in GFunds, but it has hinted about other investing opportunities to come in both local and international stocks.

Related: Once GInvest starts offering more assets to invest in, you'll need to learn how to choose the best investment options. If you want to get the best advice on how to do that, you should consider subscribing for an investment newsletter like Capitalist Exploits.

Features Of GInvest

GInvest was launched with the hopes of motivating Filipinos to try investing. As such, the platform comes with some features that are effective in helping first time investors understand and navigate GInvest properly.

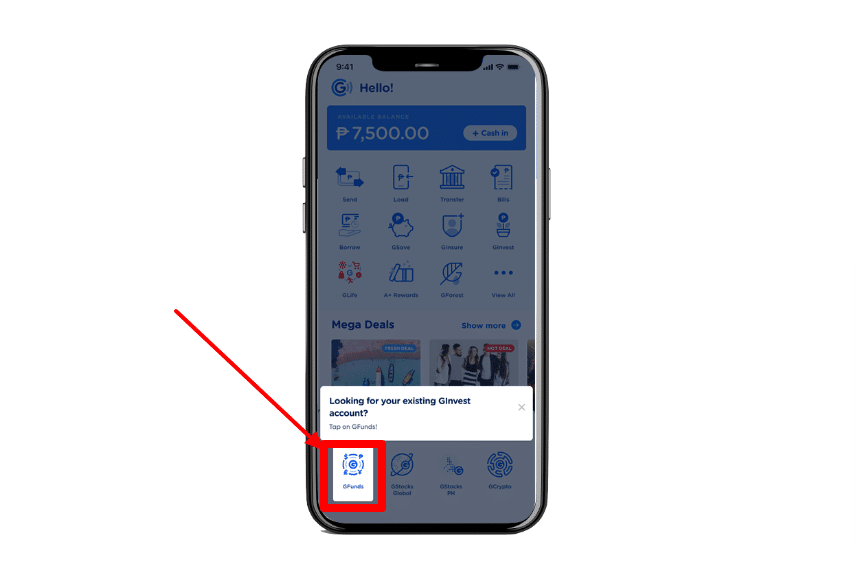

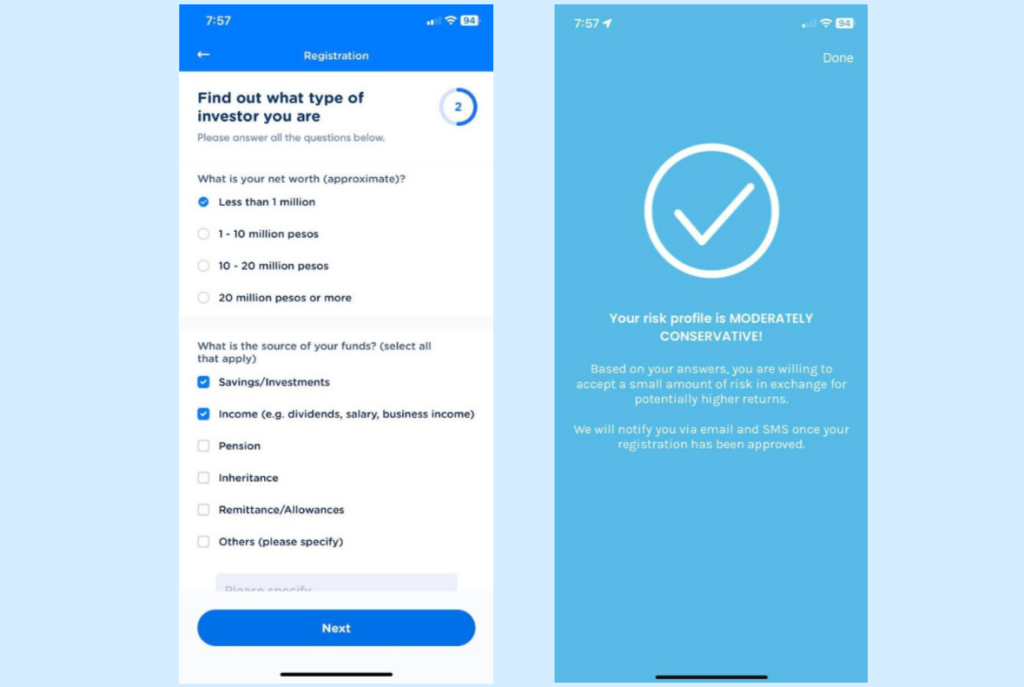

#1 Risk Profiling

Before you can try out GInvest, the platform first requires you to complete a registration process through the main GCash application. This registration process also acts as a risk profile identification process, as you’ll have to answer questions about how knowledgeable you are in investing and how much risk you are willing to take on in case the fund’s value depreciates. Some of the profiling questions include:

- What is your net worth?

- What is your monthly income?

- What is the source of your funds?

- Do you have a regular liquidity requirement?

Based on your responses, your risk profile is generated and will tell you your most likely behavior as an investor. Additionally, the registration process also has provisions dedicated for U.S. citizens who would want to invest via the platform, so it’s not limited to Filipinos.

#2 Monthly Dividends

One good feature about GInvest that is particularly enticing to many users is that it pays out monthly dividends to its clients. Through the ALFM Global Multi-Asset Income Fund, you’re paid dividends based on the formula:

(Number of fund units owned) x (unit dividend) x (Net Asset Value Per Unit or NAVPU)

Monthly dividends are a good way to jumpstart your investing career via GInvest, especially considering that these dividend assets still pay out dividends even when the value of the fund declines. If you invest through the ALFM fund, you’re also given a dividend notice by email about your dividend payment for the month, which usually arrives on the second week of each month.

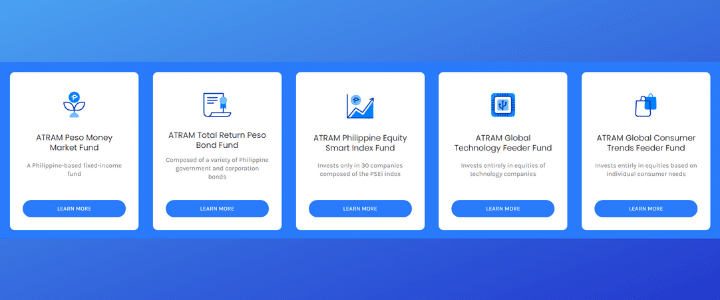

#3 Investment Products Depending On Your Risk Tolerance

The earlier mentioned registration/risk profiling process not only determines what type of investor you are, but also determines which type of investment products work best for you. GInvest has an array of different investment options via the ATRAM Group, an asset management and financial advising company. Here are some of the investment products you can choose from based on your risk appetite:

- Conservative Investors:

- ATRAM Peso Money Market Fund.

- Moderate investors:

- ATRAM Total Return Peso Bond Fund.

- ALFM Global Multi-Asset Income Fund.

- Aggressive investors:

- ATRAM Philippine Equity Smart Index Fund.

- ATRAM Global Technology Feeder Fund.

- ATRAM Global Consumer Trends Feeder Fund.

Each type of fund has its own unique characteristics and minimum initial investment, which we’ll discuss further down this article.

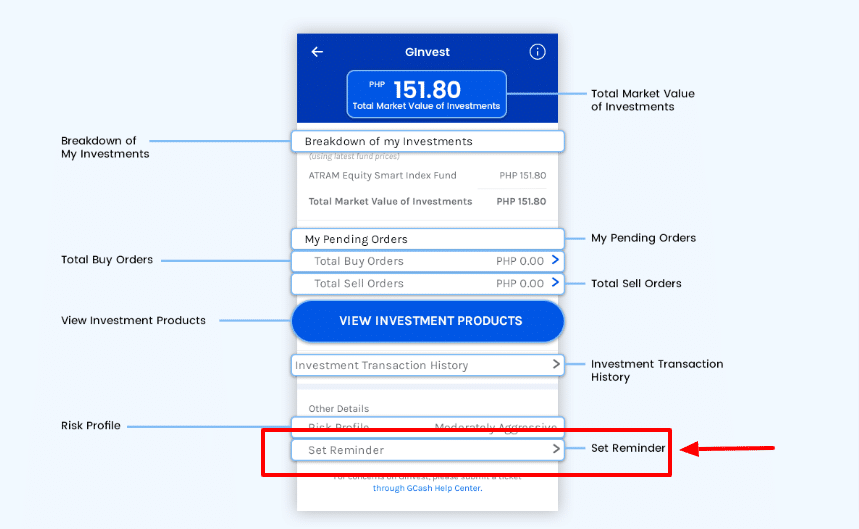

#4 Email And SMS Alerts

This feature of GInvest is helpful especially for users who are new and especially doubtful regarding the movement of their investment. The GCash platform itself gives out regular notices via SMS whenever an update is underway. With GInvest, investors also get alerts whenever the fund value changes and a reference number is kept for every transaction done through the platform.

For example, when investing in the ALFM Global Multi-Asset Income Fund, you’ll receive a text message confirming that your payment has gone through. Additionally, a separate text message will be sent stating that your order was completed. As stated above, the platform also gives out a dividend notice which details the amount of dividend you’ll receive for the month, the record date, NAVPU, Total Unit Dividend Received, and the settlement date for the dividend.

Pros Of GInvest

Despite having been around for only a couple of years, GInvest has some notable advantages that make them a good choice for many newbie investors.

#1 A Convenient Way To Start Investing

GInvest operates in a convenient, fully digital platform that allows clients to invest and receive dividends on the go using their mobile phone or another device. As such, it's a great way to invest and make money for filipinos.

#2 Operates In The GCash App

GInvest functions as one of the many major products of GCash, and it shares the reputation that the e-wallet has as the biggest and most widely-used e-wallet and money transfer platform in the Philippines.

#3 You Can Invest As Low As P50

GInvest allows their clients to invest in products that will require a minimum investment of P50 ($0.90 USD) to begin their investing journey. This is important as some platforms have minimum requirements of hundreds to thousands of dollars.

#4 Variety Of Investment Products To Choose From

Depending on your risk appetite and investment needs, GInvest has several options or investment opportunities you can try out. These include dividend-paying funds and other types of assets.

#5 Opportunity To Earn Passively

GInvest, through the ALFM Global Multi-Asset Income Fund, offers a way for new and experienced investors to earn passive income through the monthly dividends that the fund offers.

#6 No Transaction Fees

GInvest classifies as a no-fee broker and is one of the most affordable investment platforms in the Filipino scene.

Cons Of GInvest

While GInvest has some aces up its sleeves that make it a good choice for new investors, there are some areas of the investment platform that users need to consider before taking the plunge.

#1 Long Waiting Times

When doing an order via GInvest, it usually takes three to four banking days before the order is reflected to your account and is verified.

#2 Relatively Low Dividend Payout

Even though GInvest has an investment product that pays out monthly dividends, it is not as big as others may think and is not comparable with other riskier investment products.

#3 It Doesn’t Have A Standalone App Of Its Own

As of writing, GInvest is only accessible through the GCash app, so it’s impossible to access your investments outside of the main platform and also in the event that GCash is down or under maintenance.

#4 No Advanced Investment Or Trading Features

Contrary to other longer-standing brokers like Capital, GInvest doesn’t offer advanced market research and analysis tools to help experienced traders make the best investment decisions.

Pricing

One point worth noting for GInvest is that it doesn't charge fees for buying or selling your investments. You can start your investing career right away as long as you have a fully verified GCash account and have gone through the risk profile assessment, and of course, if you have at least P50 to begin investing.

Case in point, the ALFM Global Multi-Asset Income Fund allows you to begin investing without paying a transaction fee, and still expect a dividend at the end of the month (but this investment product does have a higher P1,000 minimum investment).

Hidden Fees

Although GInvest itself doesn’t charge any transaction fees, GInvest’s partner fund managers do charge management fees for the different funds they offer as investments through GInvest. The reason why you don’t see these fees reflected anywhere is that they’re baked into the fund’s NAVPU or net asset value per unit.

Some consider this as a way to hide fees from investors and to give the impression of receiving a free or very low-cost service when that’s not really the case.

The following table summarizes the fees associated with all the investment options in GInvest.

| Fund Name | Annual Trust fee |

| ATRAM Philippine Sustainable Development and Growth Fund | 1.75% |

| ATRAM Global Equity Opportunity Feeder Fund | 1.15% |

| ATRAM Global Health Care Feeder Fund | 1.15% |

| ATRAM Global Infra Equity Feeder Fund | 1.15% |

| ATRAM Global Technology Feeder Fund | 1.15% |

| ATRAM Global Consumer Trends Fund | 1.15% |

| ATRAM Philippine Equity Smart Index Fund | 1.50% |

| ATRAM Total Return Peso Bond Fund | 1.10% |

| Philippine Stock Index Fund | 1% |

| ALFM Global Multi-Asset Income Fund | 1% |

| ATRAM Peso Money Market Fund | 0.50% |

Typical management fees are usually in the range of 0.20% to 2.00%, averaging at about 1.10% of the investment. This makes most of the management fees charged by those funds average at best, with one on the higher end (ATRAM Philippine Sustainable Development and Growth Fund) and one on the lower end (ATRAM Peso Money Market Fund).

Minimum Investment Requirements

Besides fees, you must consider that the different investment products GInvest offers come with different minimum buy and sell requirements. The following table summarizes those minimum investment amounts under different investment products in GInvest:

| Fund | Risk Rating | Buy Amount (min) | Sell Amount (min) |

| ALFM Global Multi-Asset Income Fund | Moderate | P1,000 | P1,000 |

| ATRAM Peso Money Market Fund | Conservative | P50 | P50 |

| ATRAM Total Return Peso Bond Fund | Moderate | P50 | P50 |

| ATRAM Philippine Equity Smart Index Fund | Aggressive | P50 | P50 |

| ATRAM Global Technology Feeder Fund | Aggressive | P1,000 | P1,000 |

| ATRAM Global Consumer Trends Feer Fund | Aggressive | P1,000 | P1,000 |

Investment Products Under GInvest

Despite seeming like a basic investment platform for newbies, GInvest doesn’t limit its users to a single investment product. To help expand their knowledge in investing, GInvest has the following products clients can try out and learn about:

ALFM Global Multi-Asset Income Fund

The ALFM fund is an open-ended mutual fund that was incorporated into the GInvest platform after they partnered with BPI, a notable bank in the Philippines. Its objective is to provide investors an opportunity to earn a stream of dividends and also achieve long-term capital growth.

ATRAM Peso Money Market Fund

The ATRAM Peso Money Market Fund is more focused on investing in money market and short-term fixed income instruments. This type of fund is ideal for investors whose risk appetite falls under the conservative level, and it aims to preserve capital through exposure in low-risk but also low-return instruments.

ATRAM Total Return Peso Bond Fund

The ATRAM Total Return Peso Bond Fund is made up primarily of Philippines government bonds and corporate bonds, and it’s suitable for investors who have a moderate risk appetite. With this type of fund, investors are encouraged to maintain the principal amount of their investment while seeking opportunities for potential capital gains.

ATRAM Philippine Equity Smart Index Fund

The ATRAM Philippine Equity Smart Index Fund is categorized as an aggressive type of investment because it only invests in 30 companies that participate in the Philippine Stock Exchange (PSE). The aim of this fund is to provide excess returns through its own enhanced index approach.

ATRAM Global Technology Feeder Fund

The ATRAM Global Technology Feeder Fund focuses on investing in equities of global technology companies such as Microsoft, Apple, Visa, and Samsung. This aggressive type of fund aims to achieve long-term capital appreciation through the investment of all its assets in global technological companies.

ATRAM Global Consumer Trends Tech Feeder Fund

The ATRAM Global Consumer Trends Tech Feeder Fund is an aggressive fund that invests in companies that cater to the specific needs of the people. Some companies where this fund invests include Sony, Amazon, and General Motors.

In Summary

GInvest is a digital investment platform that empowers Filipinos to begin their investment journey through its different investment products. With GInvest, you can get started with investing for as little as P50, though we believe GInvest isn't a particularly good way to make money due to its low dividend payout and lack of a standalone app.

If you want to earn a signup bonus, click here to open an account with Kraken, our #1-ranked crypto exchange worldwide. With top-notch security and trading fees below 0.2%, Kraken is an excellent choice for crypto traders anywhere in the world.

GInvest FAQs

Is it good to invest in GInvest?

Yes, GInvest is a good platform to invest in if you are a beginner and know very little about investing. The platform is easily accessible through the GCash app; it allows you to assess your investment profile and risk tolerance, or “appetite,” as they call it, and can help you start your career in investing.

But if you’re looking to optimize your returns and perform advanced market analysis, Capital is a much better choice.

Is GInvest safe?

Yes, GInvest is safe. It is an investment platform that works under the e-wallet GCash which is one of the most trusted and secure virtual wallets in the Philippines.

How long does it take to make a transaction in GInvest?

The normal processing time for buy orders in GInvest is four business days, although some of the products are processed in 3 business days.

How do I receive my dividends in GInvest?

You’ll receive your monthly dividends from your GInvest investments credited to your GCash account every 15th of the month.