FarmTogether is a young fintech company that acts like a farmland crowdfunding platform. It allows retail investors from all over the world to invest in U.S. farmland for as little as $15,000. The key takeaway of this FarmTogether review is that this platform offers a convenient way to diversify your investments by allocating a part of your net worth to an asset that isn’t correlated to other major asset classes, making it a stable investment in times of economic turmoil and market fluctuations.

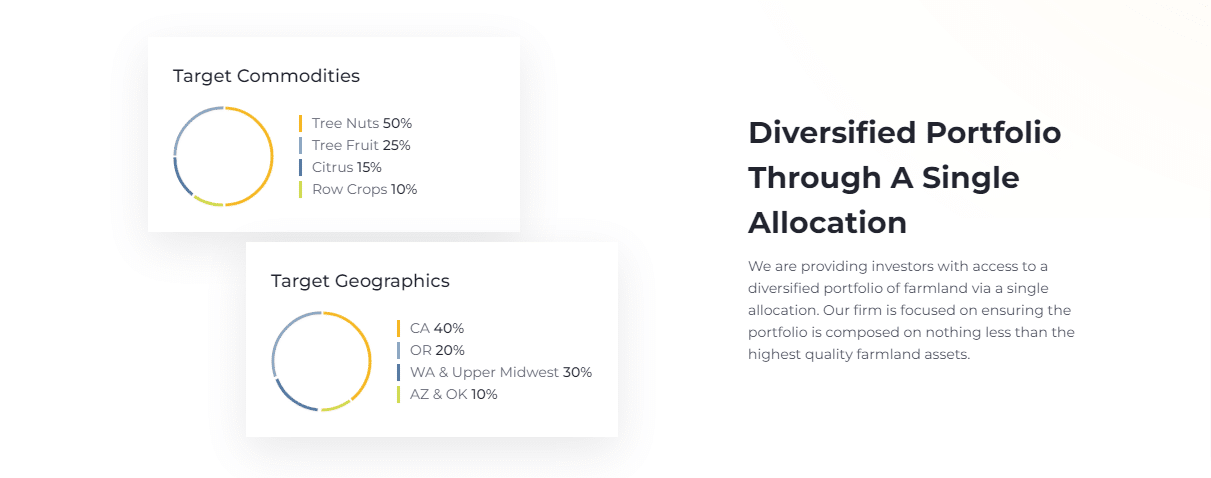

The FarmTogether platform also offers its Sustainable Farmland Fund, which is a diversified fund made up primarily of different high-quality and carefully vetted tree nut and fruit farms located in places like California, Washington, Oregon, and Arizona. This fund is only available for U.S. accredited investors, has a minimum investment threshold of $100,000, and is projected to yield an 8–10% IRR and 4–6% in annual distributions.

If you ever thought about investing in farmland but think twice about moving to the country to become a farmer, then you need to try FarmTogether. This innovative platform is changing how small retail investors invest in productive real estate like farms and orchards. In this FarmTogether review, we’ll cover what this platform is, how it works, its performance, price, pros and cons, and more.

What Is FarmTogether?

FarmTogether is a fintech investment platform that enables accredited investors to purchase stakes in farms, orchards, and other agricultural properties. FarmTogether functions similarly to real estate crowdfunding sites.

Artem Milinchuk launched the business in 2017. The company is based in San Francisco, California, and its employees have amassed more than a century's worth of expertise in agricultural investment, agribusiness, and real estate.

FarmTogether's dedication to ecological agricultural practices is one of the company's most important differentiating features. In January 2021, they stated their intention to have all of their properties comply with the Leading Harvest Farmland Management Standard. This benchmark, a first in the agricultural sector, ensures that farmland is properly and sustainably managed.

Features Of FarmTogether

#1 Tracking Your Investment

Investing in farmland has its unique challenges, but FarmTogether streamlines the process by handling everything from accounting and tax reporting to portfolio performance. Here you can select an investment strategy that works for you.

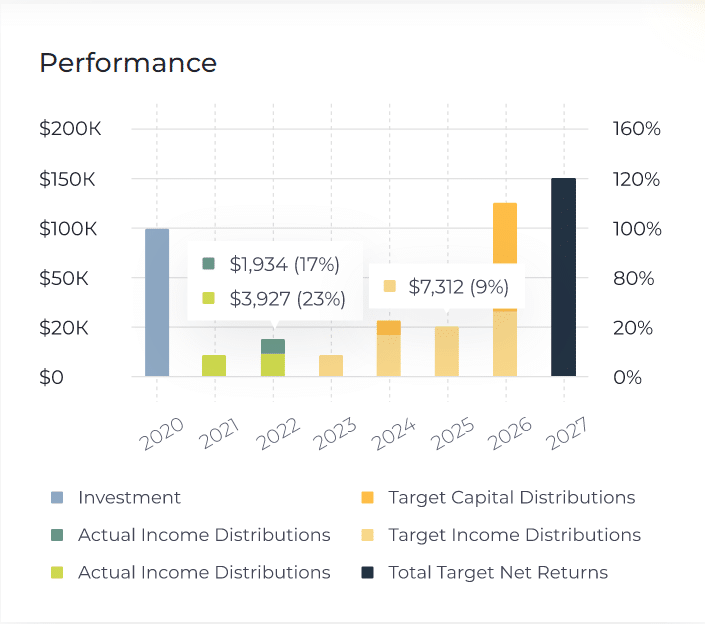

FarmTogether welcomes investments from individuals, trusts, IRAs, corporations, limited liability companies, and other legal organizations. Investors in FarmTogether have access to all relevant documentation and investment performance data, such as a comparison of expected and actual payouts, a distribution history, past dividends, and K-1 tax forms.

#2 A Profitable Source of Passive Income

Receiving rewards from agricultural activities may result in revenue from crops and an increase in the value of the land over time. Investment options with the potential for long-term revenue production are made available by FarmTogether thanks to their partnerships with local operators, their ability to negotiate favorable service agreements, and their attention to maintaining environmentally sound agricultural practices. This makes investing through FarmTogether a sustainable way to earn passive income.

The investment team at FarmTogether is in the best position to sell farmland at competitive prices and optimize the investor's capital gains when the holding term ends.

Dividends are distributed on a quarterly, semiannual, or annual basis, depending on the nature of your investment, and will be calculated based on your percentage ownership of the property. When you sign in to your account, you may see details like the dates of upcoming payments and the amounts that have already been sent. In the event of a sale, you will receive the value of your investment in the asset, plus or minus any profit or loss realized.

#3 The Investment Process

When evaluating agricultural investment prospects, FarmTogether considers both proprietary data sources and the team's prior investing expertise. To forecast pricing and value changes in target regions and crops over the long term, they consider the final consumer market for agricultural goods by studying supply and demand, consumer tastes and preferences, marketing, government restrictions, and innovation.

They consider things like the weather, water supply, regional structure, regulatory environment, and steady improvements in crop yields over time. The complexity of the agricultural environment, the cost of inputs, farmworker salaries, and local regulations are just some factors that make up their 105-point due diligence checklist.

#4 Pick Individual Properties To Invest In

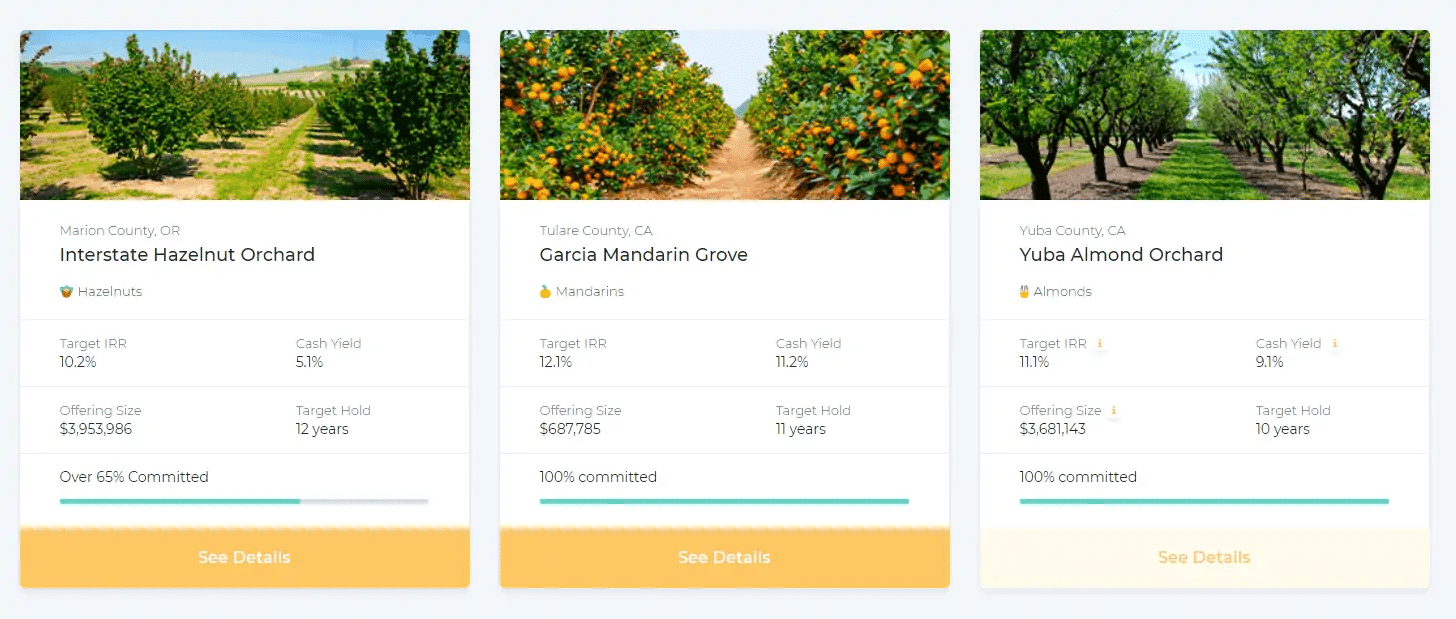

After completing due diligence, the selected properties are made available as crowdfunding investment opportunities. Then, you can choose the properties that best suit your needs.

When investing, you purchase a stake in the limited liability company (LLC) that manages and owns the property. FarmTogether gives you all the information you need to make an informed decision about any investment opportunity, including the offering's overall value, the expected duration of the LLC's holding of the property, and the projected cash returns.

#5 Secondary Marketplace

The FarmTogether platform also offers an internal secondary market where investors can trade their holdings before the conclusion of the holding term. This is one of FarmTogether’s key features that make it stand out from the competition since most other investment platforms don’t provide a secondary market for agricultural investments.

Even though this feature provides flexibility and improves market liquidity, investors who want to sell their shares still have to find another investor prepared to buy them. Since this is a relatively new feature, it’s unclear how much interest there will be in purchasing shares via the secondary market. More information about the potential liquidity of your investment will become available as time progresses.

Nonetheless, if you're looking to put your money into agricultural property, you should have a long-term outlook and be prepared to see the investment through its whole holding period. It’s not wise to enter into this type of venture with short-term goals in mind since such holdings aren’t designed for that purpose.

#6 1031 Exchange

When selling an asset like farmland for a profit, you must pay taxes. However, there’s a way around this if you plan on reinvesting those profits. The Internal Revenue Code (IRC) under Section 1031 provides an exception that allows you to postpone paying tax on any gains coming from investments made in properties like farmland if you reinvest the proceeds in a similar property.

This is called a like-kind 1031 Exchange and FarmTogther makes it easy. If you use a 1031 Exchange, you can postpone paying tax on your gains until you sell the replacement asset. To be eligible, you must buy the replacement farm within 45 days of selling the first one.

#7 Sustainable Farmland Fund

Besides the assets under the crowdsourcing scheme, FarmTogether also offers accredited U.S. investors a diversified portfolio of premium sustainable farmland assets in their Sustainable Farmland Fund. The fund is made of a mix of expertly vetted farms from California, Oregon, Washington, and Arizona, among others. These farms hold permanent crops like tree nuts, fruits, and citrus trees, and 10% of the commodities are row crops.

The fund has a target net IRR of 8–10% and a target Annual Net Distribution of 4–6%. This fund isn’t for small investors, as it has a minimum investment threshold of $100,000, but if you have the financial clout, it’s a great way to diversify your investments in a non-correlated asset that’ll shield your money from market fluctuations.

FarmTogether Pros

- Innovative and user-friendly investment platform with a wide range of features.

- Provides attractive rewards and dividends on investment.

- Accepts business investments as well as pension funds.

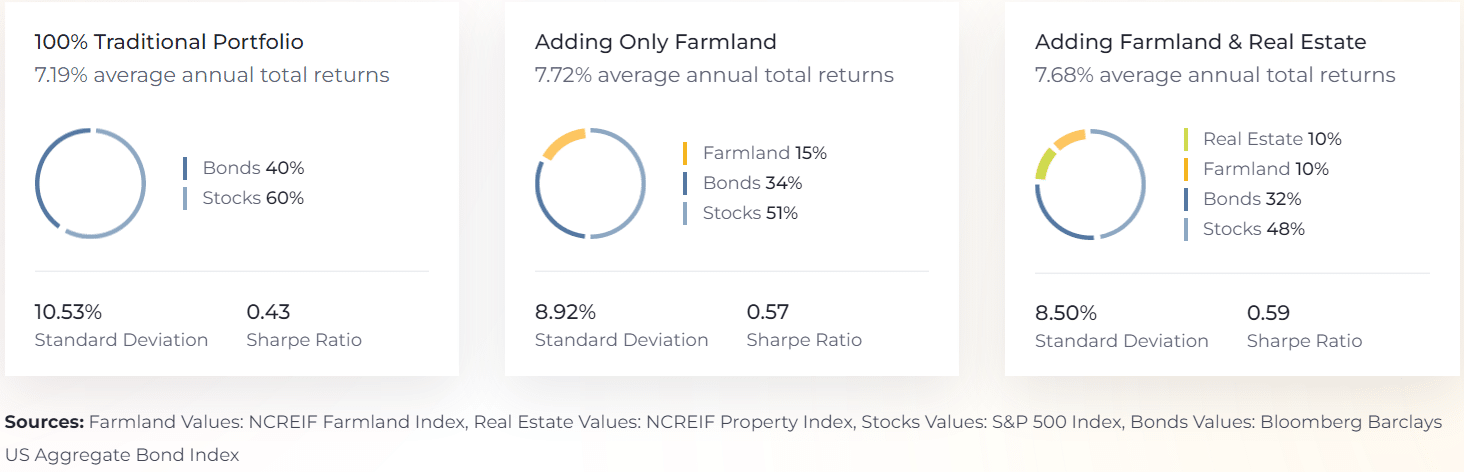

- It allows you to invest in Farmland, which is a stable, long-term, low-correlation investment.

- Foreign nationals, in addition to US citizens, are welcome to invest in crowdfunded assets.

FarmTogether Cons

- Fees are hidden from guests who haven't signed up for an account.

- Phone interaction is limited to scheduled appointments only.

- The Sustainable Farmland Fund isn’t available to international investors, only to accredited U.S. investors.

FarmTogether Pricing

Creating and exploring an account on the FarmTogether platform is free of charge. Up until the point that you invest, there will be no costs associated with doing so. The costs are different for each property since they are customized to meet the needs of each tenant.

Minimum investments range from $15,000–$50,000, with holding periods ranging from 5–12 years. The standard transaction charge is 2%, and is paid just once at the beginning of the transaction. The partners in charge of the farm's day-to-day operations are compensated with a management fee of 1–2% of the farm's total annual revenue. However, the offering paperwork should be read very carefully since each transaction has its fee structure, and in some instances, managers may share in the profits.

FarmTogether Investment Types

FarmTogether offers two types of investments:

- Fractional ownership, which refers to farmland supported by a pool of FarmTogether investors, a.k.a. crowdfunded farmland.

- Sole ownership, which refers to farmland funded by a single investor. In this case, assets are wholly owned by single individuals, households, or entities.

In contrast to traditional real estate listings, farmland assets offered via crowdfunding platforms like FarmTogether are far more approachable to the average retail investor. However, the tax benefits of 1031 exchanges are unavailable to investors with smaller portfolios since they require a commitment of at least $500,000 in a single transaction.

Before investing in any venture, FarmTogether does comprehensive research to ensure it’s a good fit with the financial goals. Instead of buying a piece of farmland and holding the title as one of dozens or hundreds of tenants-in-common, investors may buy into a limited liability company (LLC) that owns the property outright.

In any scenario, FarmTogether uses strategic investments to bring its farms up to date and optimize their processes, prioritizing sustainable farming methods and using leverage to maximize profits.

FarmFundr: An Alternative To FarmTogether

A similar company to FarmTogether is FarmFundr. FarmFundr is a more limited platform started by a fourth-generation California farmer and features just a few properties in the state.

FarmFundr has the feel of a tiny, “local” business thanks to perks like a free annual package of vegetables and an open offer to come to spend the weekend on one of the farms.

FarmFundr's holding periods are shorter than FarmTogether’s, ranging from 1–7 years, but its target returns are higher, at 13–15%. Although FarmFundr's projected returns are more significant than those advertised by FarmTogether, the platform has a shorter track record.

In Summary

FarmTogether is an innovative platform for investing in agricultural property via crowdfunding, and it has a lot going for it. Starting with a modest $15,000 investment makes it simple for investors to diversify some of their holdings into agricultural real estate. These assets are stable, long-term investments that are not correlated to almost any other asset, making them a safe haven for investors seeking to protect their savings from market fluctuations.

In short, you can invest in farms without becoming a farmer. Instead of farming, you'll act more like a landlord while reaping the rewards of owning agricultural property. FarmTogether makes investing in farmland as straightforward as buying shares via a broker. The investment is anticipated to provide yearly income from net rentals and capital appreciation upon resale.

FarmTogether FAQs

How good is FarmTogether?

With FarmTogether, you can expect to earn 7-13% after fees. Their ability to accomplish this while only taking on low-risk initiatives speaks volumes about the quality of the investment team behind FarmTogether. FarmTogether's returns are earned both via capital appreciation and regular revenue.

Do you have to be an accredited investor to invest in FarmTogether?

Yes. FarmTogether does not presently accept investments from non-accredited investors; nevertheless, the company is exploring methods to expand its investor base.

How does FarmTogether work?

FarmTogether's primary sources of revenue include the sale of land, the sale of crops, and leasing payments. Every year, their staff uses the expertise of local analysts to get reliable agricultural valuations, and they work diligently to purchase property at a discount.

Who owns FarmTogether?

FarmTogether's CEO and co-founder, Artem Milinchuk, has worked in food, agricultural, and farmland finance for over ten years. In addition to his BA and MA in Economics from the Higher School of Economics, he also has an MBA from The Wharton School.

Is FarmTogether legit?

Yes, FarmTogether is a legitimate and reputable firm that provides real estate investment opportunities, including farmland, to certified investors.

Is FarmTogether a good investment?

FarmTogether is an excellent investment. Some of the world's wealthiest individuals utilize farmland as a means of diversifying their portfolios since it has been one of the asset classes with the highest returns over the previous two decades. Nevertheless, finding a decent deal and doing your investigation are the keys to investing in agriculture.

How do I cash out on FarmTogether?

Farmland investment returns are distributed after the holding term ends. You will get direct deposits into your bank account on a weekly, semiannual, or annual basis for lease payments. Your yearly dividends will equal the number of lease payments you and the company have agreed upon. The system provides an online ledger for keeping tabs on such payments and other revenues.

Alternatively, FarmTogether also offers an in-house secondary market where FarmTogether investors can sell their holdings to other investors before the asset's term. This is a way to cash out early, but it's not guaranteed.