I've tested more than 100 brokers—first to find a trading platform for my own personal use, and later to write about them here—and Capital.com is one of the best I've used to date. It has a streamlined, powerful interface, and its commitment to zero commissions (aside from buy-sell spreads and overnight fees) means you can make the trades you want within a fair trading environment.

With the ability to trade stocks and crypto CFDS in a single place, plus the dedicated account manager every new user receives, I'm confident you'll be happy trading with Capital.com. Click below to open your account today.

82.67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

If you're reading this Capital.com review on your phone, click the “Try free demo” button on Capital.com's website, not the “Get the app” button. You can't use the app without first opening an account.

| Fees | 10 |

| Signup Process | 10 |

| Minimum Deposit | 10 |

| Ease of Use | 10 |

| Deposit & Withdrawal Options | 10 |

| Customer Support | 10 |

| Asset Classes | 10 |

| Referral Program | 0 |

| Demo Account & Educational Resources | 10 |

| Regulation | 10 |

| Total | 90 |

What Is Capital.com?

Built by a hybrid team of software developers and bankers, Capital.com leverages a unique method of processing transactions that improves market efficiency and allows them to offer commission-free trading: you just pay the buy-sell spread and overnight fees.

Capital.com has group entities authorized and regulated locally by the Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), the UAE Securities And Commodities Authority (SCA), and the Securities Commission of the Bahamas (SCB). In this Capital.com review, we'll dive deep into every aspect of the trading platform, including its fee structure, the asset classes you can trade, customer support, and more.

Capital.com is available in nearly every country in the world—including the Netherlands, Germany, the United Kingdom, Singapore, Hong Kong, and others—with the exception of the United States, Taiwan, Belgium, and a few island nations.

Pros & Cons of Capital.com

Pro #1: Zero Commissions

I'll elaborate on this more below, but it's worth mentioning again here that you won't pay any fees (aside from spreads and overnight fees) when you trade CFDs with Capital.com. This is a big deal.

Pro #2: Trade CFDs on Stocks & Crypto In A Single Place

There are surprisingly few brokers that allow you to trade both stocks and crypto CFDs in a single place, and Capital.com is one of those brokers. Better yet, rather than having to use complex crypto wallets, you can trade all your crypto CFDs just as you would any other stock right inside the Capital.com trading platform.

Pro #3: Dedicated Account Manager

I elaborate in section #6 below why I'm such a fan of Capital.com's customer support structure, which assigns every user with a dedicated account manager.

This may not seem like a big deal, but trust me when I tell you it's absolutely game-changing.

Imagine never waiting on hold again…

Pro #4: Top-Notch Desktop & Mobile App

The Capital.com desktop trading platform and mobile app combine beauty and power in a single package. I appreciate the app's clean interface while knowing I can make complex trades in the web platform whenever I need to.

I've been trading with Capital.com for more than 3 years now, and there's only one disadvantage I've found with them in all that time.

Pro #5: The Perfect Demo Account

You might be thinking, “Who cares about the demo account?” and I felt the same way before I started trading with Capital.com. But now I use my demo account as a testing ground where I can try out my trading strategies with zero risk.

Con #1: No Referral Program

As I mentioned in section #8 of this Capital.com review, they don't offer a referral program. This doesn't matter if you just want to trade on your own, but if you plan to sign up your friends as well, it means you won't get anything in return.

Of course, many other trading platforms also don't offer referral programs, so before you let the lack of a referral program turn you away, recognize that this is more of an industry problem than it is a problem specific to Capital.com.

Account Types

Unlike other brokers, some of which have dozens of account types with different fee structures and capabilities, Capital.com keeps it simple with a single account type, making it very easy to use.

#1 Fees

With Capital.com, you won't pay any fees:

- Zero signup fees

- Zero deposit fees

- Zero withdrawal fees

- Zero “per-trade” fees

- Zero commissions on trades

- Zero fees for real-time quotes

- $10/month inactivity fees (only applied if you don't trade for an entire year)

In fact, there's only two other types of fee you'll find yourself paying with Capital.com (assuming you make a trade at least once every 12 months): spreads and overnight fees.

Every trading platform charges overnight fees on leveraged trades (otherwise known as margin trading, when you borrow money from the trading platform to make larger trades), and because Capital.com's overnight fees are some of the lowest in the industry, it's also a great choice.

(Note: If you aren't familiar with leveraged trading, we suggest trading without leverage for at least a few months before diving into it. Leverage magnifies both profits and losses.)

Capital.com has low bid-ask spreads that are always shown transparently before you make every trade.

Capital.com Fees Score: 10/10

#2 Signup Process

The signup process for Capital.com is fully online (no need to mail or fax in any documents), and you can start trading as soon as you open your account.

The signup process is user-friendly. Capital.com just asks you a few basic questions (name, date of birth, country of residence, questions to assess your risk profile, etc.), plus a suitability test to ensure you're ready to start trading. You'll need to verify one piece of government-issued ID, so have your driver's license, passport, or another piece of ID on hand.

Capital.com Signup Process Score: 10/10

#3 Minimum Deposit

Capital.com carries a minimum deposit of just $20, €20 or £20 by card (and $50 via wire transfer) depending on the base currency you choose for your account. Let me explain how that works.

When you sign up for Capital.com, you'll need to choose your base currency from either the U.S. dollar, the Euro, or the British pound. The best currency for you is the currency of the markets you plan to trade. For many of us, that's going to be the U.S. dollar since most of the major global markets use the dollar. But if you want to trade on exchanges in Europe or elsewhere, you may want to choose the Euro or the pound.

Capital.com Minimum Initial Deposit Score: 10/10

#4 Ease of Use

I used to only use the Capital.com web platform to make my trades, and I loved it. But in the past two years or so, I've been doing more mobile trading in the app since I started trading more frequently.

Both platforms are extremely easy to use, though what surprised me the most is how powerful the mobile app is. You can do nearly everything on the mobile app, including complex technical analysis and charting, plus get all the research you could want about a stock right there.

The Capital.com app has a 4.4/5 rating on the Google Play Store and a 4.8/5 rating on the Apple App Store.

Capital.com Ease of Use Score: 10/10

#5 Deposit & Withdrawal Options

Capital.com accepts deposits via credit card, debit card, bank transfer, electronic transfer, and wire transfer. It processes deposits via credit card, debit card, and bank transfer.

I've deposited money into my Capital.com account in two ways: via credit card and via bank transfer. The credit card deposits show up in my account instantly (less than 5 seconds), while the bank transfers normally take about 2 business days.

Withdrawals take about 2 days to process, regardless of the method.

You can deposit money into Capital.com in U.S. dollars, Euros, or British pounds.

Capital.com Deposit & Withdrawal Options Score: 10/10

82.67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

#6 Customer Support

One of the reasons I switched to Capital.com was because of their best-in-class customer support, and they haven't let me down.

When I first opened my account, I was assigned a dedicated account manager who would handle any questions or problems that came up for me. I was given my account manager's direct email address and phone line and told to call her any time I needed anything.

I've called my account manager a few times in the past 3+ years, and she generally picks up after just a couple of rings (about 10-15 seconds). Once or twice she's been helping another caller, but then I just leave her a quick voicemail asking her to call me back. It's never taken more than 15 minutes to hear back from her.

On top of having a dedicated account manager available via phone and email, Capital.com also offers 24/7 support through online live chat and WhatsApp as well. In my experience, Capital.com answers on these platforms in about 5 minutes or less.

Capital.com offers support in at least 8 languages: English, German, French, Italian, Spanish, Russian, Turkish and Arabic.

Capital.com Customer Support Score: 10/10

#7 CFDs on Asset Classes

Stocks

- Trade thousands of stock CFDs from large and small stock markets in these countries: United States, Canada, United Kingdom, Germany, France, Hong Kong, Japan, China, Singapore, Italy, Ireland, Norway, Russia, Spain, Sweden, Switzerland, and others

- Dozens of global exchanges are available to trade CFDs on

- Perform technical analysis from inside Capital.com's web platform or mobile app

Currency Pairs

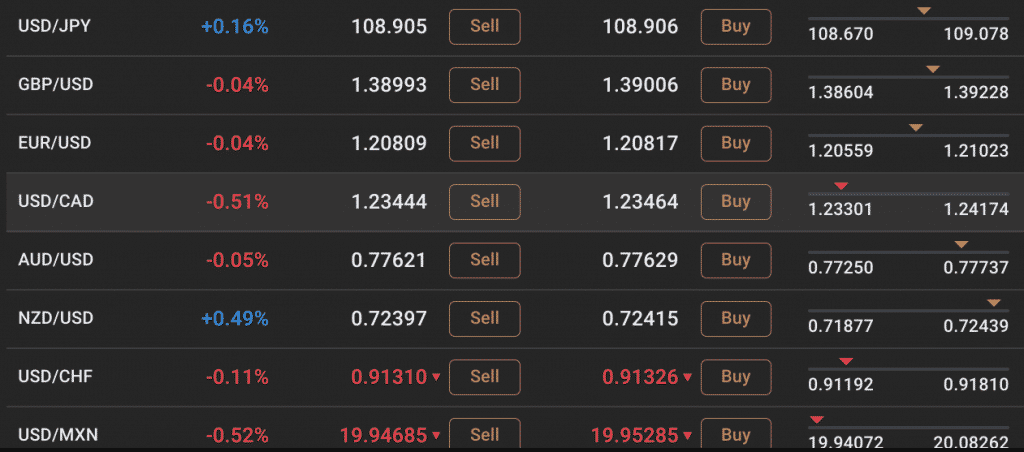

- All of the major currency pairs—plus hundreds of less popular currency pairs—are offered, including pairs with USD, EUR, JPY, GBP, CAD, AUD, CHF, CNY, HKD, SGD, SEK, NOK, DKK, RUB, TRY, PLN and more. All of the major currency pairs have competitive spreads, and most of the minor currency pairs have favourable spreads, too. This is one of the reasons why Capital.com has become quite popular among both retail traders and professional traders.

Commodities

- Popular markets like oil, gold, silver, copper and natural gas

- Less popular markets like carbon emissions, orange juice, cotton, aluminum, sugar, wheat, cocoa, coffee and palladium

ETFs

- Vanguard High Dividend Yield Index Fund ETF

- Vanguard Real Estate ETF

- ALPS Medical Breakthrough ETF

- Direxion Daily Technology Bull 3x Shares

- Many ARK ETFs (ARK Innovation ETF, ARK Genomic Revolution ETF, ARK Autonomous Technology & Robotics ETF, etc.)

Indices

Capital.com offers a number of indices and thematic investments. Here are some of the more interesting ones you can trade CFDs on:

- Berkshire 10 Index

- CMIC E-commerce Index

- Corona Anti-Virus Index

- Crypto Index

- E-Sports Index

- Electric Cars Index

- US Airlines Index

- US Cannabis Index

Cryptocurrencies

- Major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Dogecoin (DOGE), Ripple (XRP) and more

- Smaller cryptocurrencies and altcoins like Litecoin (LTC), Cardano (ADA), 0x (ZRX), Bitcoin Cash (BCH), Nem (XEM), Stellar (XLM) and more

Capital.com Asset Classes Score: 10/10

#8 Referral Program

The lack of a referral program is really the only drawback to Capital.com, though that's not unusual: many online brokers don't have referral programs, either.

This means Capital.com receives a 0/10 score, similar to many other trading platforms.

Capital.com Referral Program Score: 0/10

#9 Demo Account & Educational Resources

Capital.com's demo account is as good as it gets. Why? Because it's the exact same as the real trading experience.

Unlike other brokers, many of which impose arbitrary time limits on their demo accounts (7 days, for example), you can use the Capital.com demo account for as long as you want.

My favourite thing about it is that you can toggle between your demo and live trading account with a single click. I frequently use my demo account to test out trading strategies risk-free: if it works out, I'll do the same with real money, and if it doesn't, I won't.

As for educational materials, Capital.com has plenty. Users can access helpful training videos from right inside the trading platform, and there are hundreds of helpful blog posts and videos on the web platform and inside the mobile app as well.

Capital.com Demo Account & Educational Resources Score: 10/10

#10 Regulation

Capital.com is regulated by four distinct financial regulatory bodies:

- Financial Conduct Authority (FCA) in the UK

- Australian Securities and Investments Commission (ASIC) in Australia

- Cyprus Securities and Exchange Commission (CySEC) in Cyprus

- Securities And Commodities Authority (SCA) in the UAE

- Securities Commission of the Bahamas (SCB) in Bahamas

Each of these regulators has its own rules designed to protect users and investors. For example, the Financial Conduct Authority covers deposits up to £85,000, which means that if Capital.com went bankrupt, you'd get back 100% of your account balance up to £85,000. The Investors Compensation Fund (ICF) also covers retail funds up to £20,000, which offers further assurance.

Capital.com also offers a unique security feature for retail traders called Negative Balance Protection, which protects you when the positions in your account drop in value. Negative Balance Protection ensures you can never lose more money than what you've deposited into your account.

Capital.com Regulation Score: 10/10

In Summary

I've tested more than 100 brokers—first to find a trading platform for my own personal use and later to write about them here—and Capital.com is the best I've used to date. It has a streamlined, powerful interface, and its commitment to zero commissions (aside from buy-sell spreads and overnight fees) makes for a great overall trading environment.

With the ability to trade CFDs on stocks and crypto in a single place, plus the dedicated account manager every new user receives, I'm very confident you'll be happy trading with Capital.com. Click the button below to open an account today.

82.67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Capital.com FAQs

How does Capital.com work?

Capital.com works in the same way as most other brokers: it provides a marketplace for traders to trade CFDs on stocks, commodities, indices, forex, and cryptocurrencies.

What sets Capital.com apart is its commitment to zero commissions, its customer service, and its easy-to-use website and mobile apps.

Is Capital.com good for beginners?

CFDs are risky and carry the possibility of losing money, but yes, Capital.com is a good platform for beginner traders for a number of reasons:

- Zero Commissions: The most important thing new traders should be looking for is a platform with zero commissions, which is what Capital provides. (Other fees apply)

- Simple User Interface: Both the desktop and the mobile app are easy to use, even for beginners who have never traded before (see section #4 above for screenshots).

- Excellent Customer Support: As a new trader, you're going to have questions about how things work. Rather than joining one of the big institutional brokers who make you wait on hold for 90 minutes or more just to answer a simple question, we suggest joining a smaller trading platform that can provide real-time support when you need it.

If you're a beginner trader just starting out, I recommend using Capital's Demo Mode to gain some experience, since investing can be risky and you don't want to lose money if you can avoid it.

Can I trade crypto CFDs with Capital.com?

Yes, you can trade crypto CFDs with Capital.com, including Bitcoin, Ethereum, Dogecoin, and dozens of other coins.

Where is Capital.com based?

Capital.com has offices in London, Gibraltar, Limassol, Dubai, and Australia. It is regulated by the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC) in Cyprus, and the Australian Securities and Investments Commission in Australia, and the Securities Commission of the Bahamas (SCB).

Can I trade options with Capital.com?

No, users cannot trade options with Capital.com. Options are a much riskier investment type that should only be used by professional traders.

What is the minimum deposit for Capital.com?

The minimum deposit for Capital.com is $20, €20 or £20 by card or $50, €50 or £50 by wire, depending on the currency you choose for your account. For example, if you choose US dollars as the base currency of your account, your minimum deposit will be $20.

How does Capital.com make money?

Capital.com makes money on the spread (also known as the bid-ask spread) between the buy price and the selling price on every trade, just like all brokers. Unlike most other brokers, Capital.com chooses not to charge other fees like trade commissions and withdrawal fees, though it does charge overnight fees.

How do I withdraw money from Capital.com?

You can withdraw money from Capital.com via credit card, debit card or bank transfer to your bank account. All withdrawals take about 24 hours to be processed, and there are no fees involved.

Is Capital.com reliable?

Yes, Capital.com is a reliable broker that's regulated by some of the world's most well-respected financial regulators, including ASIC, CySEC, SCA, SCB, and the Financial Conduct Authority (FCA) of the United Kingdom. It has a successful track record and has been operating since 2016.

Can I trust Capital.com? Is Capital.com legit?

Yes, Capital.com is a reliable broker you can trust.

CFDs are complex instruments and come with a high risk of losing

money rapidly due to leverage. 82.67% of retail investor accounts lose

money when trading CFDs with this provider. You should consider

whether you understand how CFDs work and whether you can afford

to take the high risk of losing your money.