If you prefer a more hands-on approach when it comes to investing, trading platforms might be for you. Trading platforms provide a lot of flexibility: investors can pick and choose particular investments and build their portfolio from the ground up; one major drawback is that you need to have a solid understanding of the stock market.

After reviewing dozens of trading platforms, there is one that ranks above in terms of fees, ease of use, and overall flexibility: Qtrade. For starters, Qtrade doesn’t charge monthly or deposit fees, there’s no minimum deposit, and it comes with a comprehensive suite of research tools that puts it ahead of the competition.

Here are my selections for the best online brokers in Canada:

- Qtrade – Best Overall

- Wealthsimple Trade – Best Research Tools

- Questrade – Best Insurance Coverage

- CIBC Investor’s Edge – Best For Experienced Investors

- Interactive Brokers – Lowest Fees

- TD Direct Investing – Best For Mutual Funds

The 6 Best Online Trading Platforms In Canada

1. Qtrade – Best Overall

Qtrade is, without a doubt, the best trading platform in Canada. It’s been around for more than 20 years, and is currently offering a $50 signup bonus for new users.

Qtrade is an extremely low-fee platform: it doesn’t charge any monthly fees or deposit fees, and there’s no minimum for opening an account. Qtrade investors can buy hundreds of US and Canadian ETFs fee-free, and other ETFs, stocks and mutual funds cost just $8.75 per trade, regardless of the trade size. Options cost $8.75 per trade + $1.25 per contract.

Qtrade is a member of the Investment Industry Regulatory Organization of Canada (IIROC) and the Canadian Investor Protection Fund (CIPF), which means your funds are protected up to $1 million per investor. It has an entire suite of research tools, including PortfolioSimulator—a demo account that allows you to test out portfolios in a risk-free environment—and PortfolioScorer, which calculates the overall risk of your portfolio and sends you a customized summary with recommendations.

Qtrade is compatible with FSA, RRSP, RESP, margin, and RRIFT accounts, making it a flexible account ideal for several stages of life. I’ve personally used Qtrade for years, and I can’t recommend it highly enough.

Features

- PortfolioSimulator, a test environment

- Customized reports and recommendations

- Mobile app available on Android and iOS devices

- Access to advanced charting and technical analysis from Morningstar experts

- Insured for up to $1 million

- Two-Factor Authentication (2FA)

- Compatible with FSA, RRSP, RESP, margin, and RRIFT accounts

Cost

- Stocks & Mutual Funds Trading Fees: $8.75 per trade

- ETFs Trading Fees: $8.75 per trade (select ETFs are free to trade)

- Options Trading Fees: $8.75 + $1.25 per contract

- Account Minimums: $1,000

- Account Management Fee: $25 per quarter

2. Wealthsimple Trade – Best Research Tools

Launched in 2019 as part of the Wealthsimple family, Wealthsimple Trade is Canada’s largest online investing and trading platform, with over 2 million active users. Wealthsimple Trade offers Canadians access to thousands of stocks and ETFs in the largest exchanges in the world, including the NYSE, NASDAQ, and the Toronto Stock Exchange (TSX).

Wealthsimple Trade offers two account types for new investors: a Free Account and a Plus Account. The free accounts come with no trading fees, up to $1,500 instant deposits, and access to fractional shares and real-time snap quotes. If you trade a lot on foreign markets, it may be worth considering their Plus account – it has a higher instant deposit limit of $5,000, and for just $10/month, you can create a USD account and save up on currency-conversion fees when purchasing stocks or ETFs. For comparison, free accounts are charged a 1.5% conversion fee for every transaction involving the USD.

Wealthsimple is a very secure platform that is regulated by the Investment Industry Regulatory Organization of Canada (IIROC). Additionally, all assets are protected by the Canadian Investor Protection Fund (CIPF) for up to $1 million per trader.

Features

- Robo advisor service (Wealthsimple Invest)

- High-Interest Savings Account (Wealthsimple Save)

- Highly rated Mobile App (3.9/5 rating on the Play Store and 4.7/5 on the App Store

- Access to Fractional shares

- Compatible with TFSA, RRSP, and non-registered personal accounts

- Offers a Premium upgrade with real-time market data

- $50 cash bonus when you invest with Wealthsimple Trade

- Two-Factor Authentication (2FA)

Cost

- Trading Fees: Free

- Free Account: Free

- Plus Account: $10/month

- FX Conversion Fees: 1.5% (free for Plus Accounts)

- Account Minimums: None

- Inactivity Fees: Free

3. Questrade – Best Insurance Coverage

Questrade is one of the oldest trading platforms in Canada and one of the most diverse in terms of financial products. Founded in 1999, Questrade supports thousands of stocks, ETFs, mutual funds, CFDs, and some of the best GICs in Canada,

Among Questrade’s best features are Watchlists, which allow users to keep track of all their favorite stocks in real-time. You can also set up customizable Smart Alerts and notifications to take advantage of any price fluctuations. Questrade has something for every type of investor: for advanced traders, there are advanced charting tools and Self-directed investing with preferential fees; for beginners, there are pre-built, expertly-made Questwealth Portfolios so you can begin your investing journey safely.

Questrade supports many types of trading, from stocks and options to FX and margin trading, for experienced investors. Global stock CFDs and commodities are also available, with very low spreads and commissions.

The Questrade platform is regulated and insured by the Investment Industry Regulatory Organization of Canada (IIROC) and the Canadian Investor Protection Fund (CIPF), respectively.

Features

- Robo advisor service (Questwealth Portfolios)

- Private insurance coverage for up to $10 million

- Mobile App available on Android (2/5 rating) and iOS (2/5 rating)

- Fee-free ETF purchases

- Compatible with TFSA, RRSP, RESP, LIRA, RIF, LIF, Margin, and Corporate accounts

Cost

- Stocks Trading Fees: From $4.95 to $9.95 per trade

- ETF Trading Fees: Free

- Options Trading Fees: $9.95 + $1/contract

- FX Trading Fees: 0.8 pips

- Account Minimum: $1,000

- Inactivity Fees: Free

4. CIBC Investor’s Edge – Best For Experienced Investors

CIBC Investor’s Edge is another large trading platform that was launched in 2003 as a direct competitor to some of the other, more expensive trading brokerages. It was intended as a self-contained platform, with one of the more extensive sets of tools available for self-directed investors.

CIBC IE research tools include reports from professional Morningstar analysts, three stock and ETF screeners (FeaturedScreens, QuickScreener, and CustomScreener), historical performance and portfolio information of ETFs, and a proprietary search algorithm to look up specific stock-investing opportunities within ETFs.

CIBC also offers advanced charting tools and options trading, and preferential pricing for students and active traders who make at least 150 trades per quarter. Fees start at $6.95 per trade for stocks and ETFs ($5.95 for students, and $4.95 for active traders).

In terms of accounts offered, CIBC Investors Edge benefits from being linked with the CIBC bank: traders can access registered accounts (TFSA, RRSP, and RESP), non-registered (Cash, Margin), and non-personal accounts (Corporate, Trust, Estate, Investment Club).

Features

- Student and active trader discount

- Reports from professional Morningstar analysts

- Access to 3 stock screeners (Featured Screens, QuickScreener, CustomScreener)

- Available on Android (rated 3.2/5) and iOS (rated 3.5/5)

- Educational resources

- Compatible with TFSA, RRSP, RESP, RRIF, LIRA, LRSP, LRIF, PRIF, and margin accounts

- Quick sign up process

Cost

- Stocks & ETFs Trading Fees: $6.95

- Options Trading Fees: $6.95 + $1.25 per contract

- Mutual Funds Trading Fees: $6.95

- Account Minimums: None

- Maintenance Fees: $100/year

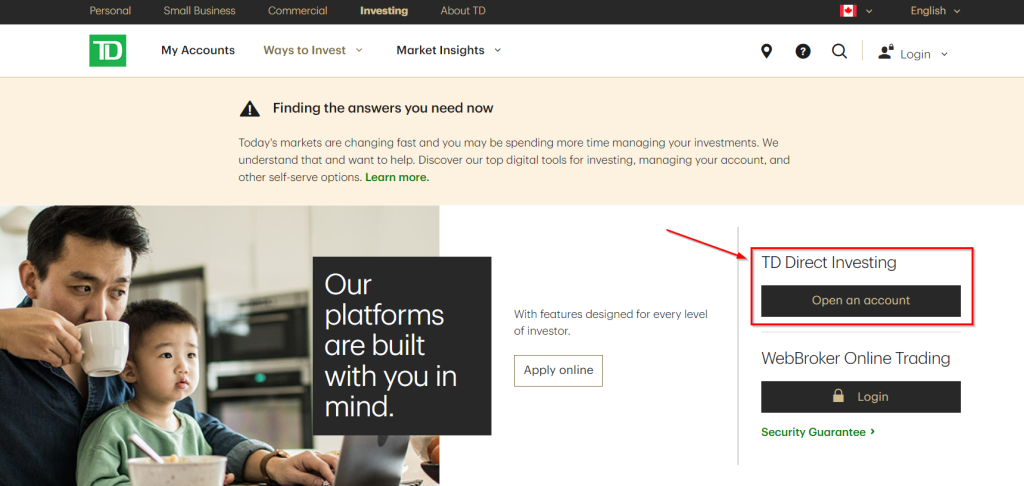

5. TD Direct Investing – Best For Mutual Funds

TD Direct Investing is an extension of the Toronto-based TD Bank in Canada. The Toronto-Dominion Bank was founded in 1955, and since then, it has launched four different trading platforms: WebBroker, TD app, Advanced Dashboard, and thinkorswim.

Usually marketed for experienced investors, TD Direct Investing offers access to real-time news and quotes, educational resources, opinions from professional analysts, and advanced charting tools. You can also sign up for daily, weekly, and special reports – including Morningstar and TD Economics reports – to help you make more informed choices.

Some advanced order types available include trailing stops, option stop limit, and short sell stops. There is also a range of conditional orders, which can be accessed on the TD dashboard on the orders tab. For active traders, the fees drop from $9.99 when trading stocks and ETFs to $7 – to qualify for this preferential pricing, users just have to complete at least 150 trades per quarter.

As a subsidiary of the Toronto-Dominion Bank, TD Investing is insured by the Canada Deposit Insurance Corporation (CDIC) for up to $100,000 in each eligible category.

Features

- Direct support from investing pros

- Access to educational resources

- Choose 4 distinct platforms: WebBroker, TD app, Advanced Dashboard, and thinkorswim

- Available on Android and iOS (3/5 rating on both platforms)

- Compatible with TFSA, RRSP, RESP, margin, and RRIF accounts

- Access to the TD Automated Investing robo advisor

- Fully regulated online broker

Cost

- Stocks & ETFs Trading Fees: $9.99 per trade

- Options Trading Fees: $9.99 + $1.25 per contract

- Mutual Funds Trading Fees: Free

- Inactivity Fees: $25 per quarter

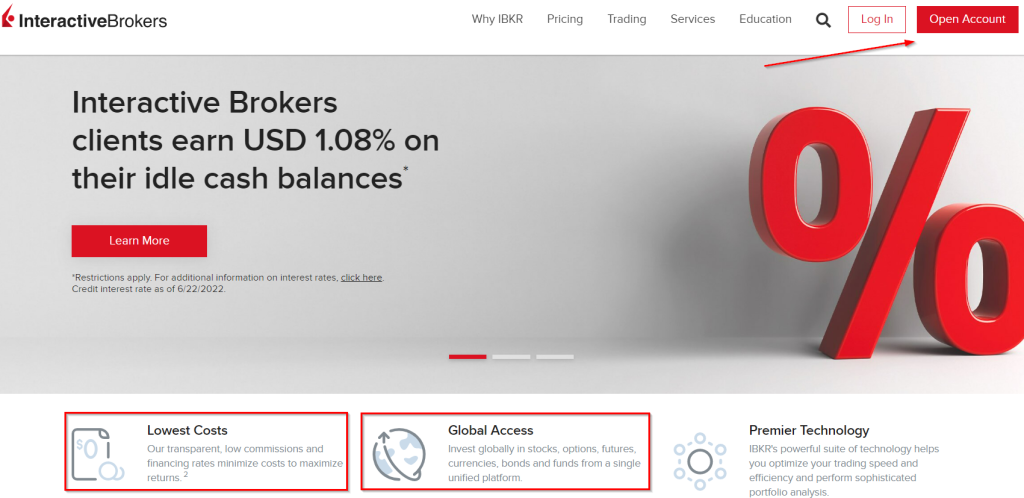

6. Interactive Brokers – Lowest Fees

Interactive Brokers Canada Inc. (IB Canada) is the Canadian branch of the US-based brokerage platform Interactive Brokers (IBKR). It started operations in Canada in 2000, and since then, it has established itself as one of the go-to platforms for experienced Canadian traders, averaging 1 million daily transactions.

IB Canada offers easy access to stocks, ETFs, and bonds from over 135 international markets, options, futures, and margin trading. Recently, IB Canada implemented fractional shares and a lending system called Stock Yield Enhancement Program, through which users can lend out their stocks and earn interests paid out daily; this is very useful if you don’t want to lose your long positions on some stocks but want to earn an additional income.

For advanced traders, IB offers 110+ order types, from the very simple limit orders to algorithmic trading and over 23 spot trading currencies. Additional tools include real-time data, free cost analysis reports, and interactive charting tools. Users can choose from a fixed or a tiered fee system – the tiered system is a great option for high-volume traders.

IB Canada is a member of the CIPF and insures assets for up to $1,000,000 for non-registered accounts, including cash, margin, and TFSA accounts. Registered accounts (RSPs) are considered different accounts for the purpose of insuring and are eligible for an additional $1,000,000.

Features

- Advanced trading features

- Access to 40,000+ funds worldwide

- Earn interest on Stock Loaning

- Educational packages

- Access to Fractional shares

- Compatible with FSA, RRSP, RESP, margin, and RRIF accounts

Cost

- Stocks Trading Fees: From $1.00 to 1% of every trade

- ETFs Trading Fees: Free

- Options Trading Fees: From $1 to $1.25 per contract

- Futures Trading Fees: $0.15 per contract

- Mutual Funds Fees: €4.95 ($6.50)

- Account Minimums: $100

- Inactivity Fees: None

What Is An Online Trading Platform?

An online trading platform is a software application that allows investors to place orders for financial securities through a broker. This can include stocks, bonds, mutual funds, ETFs, and options. Online trading platforms are typically provided by online brokers and can be either web-based or desktop-based.

Online trading platforms typically charge a commission or a fee per trade. Some platforms may also charge monthly/quarterly fees, or inactivity fees if you don’t use your account for a certain period of time.

Benefits Of Using An Online Trading Platform

There are many benefits of using an online trading platform, including:

- Real-time market data: This will help you make more informed investment decisions.

- Global markets: Trade stocks, bonds, and other securities from exchanges all around the world.

- Convenience: You can trade anytime, anywhere, from a desktop platform or mobile app that’s specifically designed to be easy to use for investors of all experience levels.

- Cost savings: Online trading platforms can save you money on commissions and fees that you’d otherwise pay to more traditional brokers

- Speed: With an online trading platform, you can place orders quickly and easily.

How to Choose An Online Trading Platform

There are a few things you should keep in mind when choosing an online trading platform, including:

- Cost: Make sure to compare the costs of different online trading platforms. This includes commissions, fees, and any other charges.

- Ease of use: The platform should be easy to use and navigate.

- Research tools: The platform should offer powerful research tools that can help you make informed investment decisions.

- Customer service: If you have any questions or problems, you should be able to easily contact customer service for help.

- Mobile app: If you want to trade on the go, make sure the platform has a mobile app that is compatible with your device.

- Security: The platform should offer industry-leading security measures to protect your account and personal information.

How Do Online Trading Platforms Work?

Most online trading platforms will charge a commission or fee per trade. Some may also charge monthly or annual fees for access to the platform. It’s important to compare the fees charged by different online trading platforms before selecting one to use. As you can see from the brokers listed above, fees can vary greatly.

Some online trading platforms are designed for active traders, while others are more suited for long-term investors. To get the most out of the broker you choose, you’ll want to opt for a platform that matches your trading style.

Some online brokers offer their own proprietary platforms while others use third-party platforms such as MetaTrader 4 (MT4) or TradeStation. In addition, some online brokers offer access to multiple platform types so that investors can find the one that best suits their needs.

Most Canadian trading platforms offer a mobile app as well, though some are significantly easier to use than others. If you’re the type of trader who likes to place trades on the go, it’s worth checking out the mobile app offerings before making your selection.

What Are The Different Types Of Online Trading Platforms?

There are two main types of online trading platforms: direct access platforms and web-based platforms.

Direct access platforms provide traders with direct access to exchanges and market data. These platforms typically have more features and tools than web-based platforms. However, they can be more expensive and may require more technical expertise to use.

Web-based platforms are designed for traders of all experience levels. These platforms are typically more user-friendly and can be accessed from any internet-connected device.

Why Should You Use An Online Trading Platform?

If you’re thinking about investing, you want to minimize the fees as much as possible. One way is to use robo advisors, which boast very small fees. If you’re looking for the lowest trading fees, you’ll want to look up Canadian online brokers, also known as online trading platforms. They’re the most cost-effective way to invest in Canada, topping both regular banks and robo advisors.

One very important drawback is that online brokers are legally barred from offering advice. They’re only intermediaries that facilitate your trade, so some knowledge about investing and stock trading, in general, is recommended.

In Summary

If you prefer a more hands-on approach when it comes to investing, trading platforms might be for you. Trading platforms provide a lot of flexibility: investors can pick and choose particular investments and build their portfolio from the ground up; one major drawback is that you need to have a solid understanding of the stock market.

After reviewing dozens of trading platforms, there is one that ranks above in terms of fees, ease of use, and overall flexibility: Qtrade. For starters, Qtrade doesn’t charge monthly or deposit fees, there’s no minimum deposit, and it comes with a comprehensive suite of research tools that puts it ahead of the competition.

Best Trading Platform Canada FAQs

What Is The Best Online Trading Platform In Canada?

The best overall online trading platform in Canada is Qtrade. It doesn’t charge monthly or deposit fees, commissions, or any other fee. It offers access to hundreds of US and Canadian securities, and there are no fees when trading ETFs.

What is the best stock trading website for beginners in Canada?

The best online trading platform for beginners is Qtrade. It has the lowest fees for a trading platform in Canada and it has a dedicated educational section for new investors looking to learn the lingo and everything there is to learn about trading.

Is There A Free Trading Platform In Canada?

Yes, Qtrade is a Canadian trading platform that doesn’t charge any monthly fee, deposit fee, or trading fee for select US and Canadian ETFs.

Are There Any Canadian Trading Platforms That Support Forex Trading?

Yes, the best trading platforms for Forex trading are Interactive Brokers, Wealthsimple Trade, and Questrade. All three have low fees and high liquidity, making them a good way to invest.

How Can I Day Trade In Canada?

To day trade in Canada, you can use any of the platforms listed here, but we strongly recommend Qtrade, Questrade, and Wealthsimple Trade, as the best platforms overall.

Is Day Trading Legal In Canada?

Yes, day trading is legal in Canada. Keep in mind that all profits from intraday trading are considered business income for the purpose of taxation (instead of capital gains). If day trading is your full-time job, you will not be eligible to claim capital gains because it is considered business income. The tax amount will depend on the trader’s particular tax bracket.

What’s The Best Trading Platform For Canadian Students?

The best online trading platform for Canadian students is Qtrade, both because it has the lowest fees and because it offers a user-friendly interface that resembles the modern apps most students use and love. For more experienced investors, Questrade is a good option as it provides access to multiple platform types and has low fees.

Do any Canadian stockbrokers offer forex trading?

Yes, several Canadian stockbrokers offer forex trading. Interactive Brokers is the most well-known for its forex trading, though Questrade and TD Direct Investing offer it, too.

How Much Do Online Trading Platforms Cost?

The cost of online trading platforms in Canada can vary quite a lot: some platforms (like Qtrade and Wealthsimple Trade) are free to use, while others charge monthly or annual fees. Most platforms also charge per-trade commissions, which can add up quickly depending on how often you trade.

Of course, you should also factor the different features of each trading platform into your decision. For example, some platforms (like Questrade) offer advanced tools like market limit orders and stop-losses, while others (like Wealthsimple Trade) don’t.

What Is The Cheapest Online Broker In Canada?

The cheapest online broker in Canada is Qtrade, which offers commission-free stock and ETF trading. It’s one of the main reasons why we recommend Qtrade as the best online trading platform for most Canadian investors.

What Is The Best Free Online Trading Platform In Canada?

The best free online broker in Canada is Qtrade. As we mentioned above, it offers commission-free stock and ETF trading and is also one of the simplest platforms to use, making it a great choice for both beginner and experienced investors alike.

Is Using An Online Broker Worth It?

Yes, we think using an online broker is definitely worth it. Not only do you have access to a wider range of investment products (like stocks, ETFs, and mutual funds), but you can also trade commission-free depending on the platform you choose, which can save you a lot of money in the long run.

On top of that, online brokers are usually much easier to use than going through a traditional bank or investment firm. So if you’re looking for the simplest and most cost-effective way to invest, we believe an online broker is the way to go.

Are Online Trading Platforms Safe?

Yes, online trading platforms are safe. In fact, they’re usually more secure than traditional investment firms since they use state-of-the-art security measures to protect your information.

Of course, like with anything else online, there is always a risk of fraud or hacking. However, as long as you choose a reputable platform and take measures to protect your account (like using a strong password), you should be able to trade safely and securely.

Are Online Trading Platforms Legit?

Yes, online trading platforms are completely legit. In fact, they’re regulated by the same government agencies as traditional investment firms (like the Canadian Securities Administrators), so you can rest assured that your money is in good hands when you trade with an online broker.