Cash App is a mobile payment app that allows users to quickly transfer money and access crypto and stock trading inside the app. If you like investing or often send and receive money to and from family and friends, chances are you've heard of Cash App. But you might wonder: is Cash App safe?

As a money transfer app, Cash App deals with users' cash and with their personal data, which are both valuable targets for modern cybercriminals. Cash App goes above and beyond to protect all of your valuable data using industry-standard means like a team of cybersecurity experts overseeing operations, cutting-edge encryption, and fraud detection technology.

However, it's easy for users to be tricked into giving away their credentials, possibly compromising the security of their money and financial information. By taking the necessary precautions, it's easy to make using the Cash App as safe as using any banking app from your most trusted bank.

With my unique Cash App referral code, you'll receive a $5 signup bonus after depositing and sending at least $5 within 14 days, plus $30 more for inviting 2 friends. That's the highest signup bonus anywhere on the web, just one more reason I can't recommend joining Cash App highly enough.

There is an inherent risk to using any app that requires your personal and financial information, so there's always an element of trust involved in signing up. This is the case with Cash App and all money-transfer and trading apps out there. However, products like Cash App that are backed by well-known names in the FinTech space have the advantage of millions of positive reviews that help build trust among potential users.

That said, even the best and most secure app in the world can't completely avoid the risk of the user making a mistake or being scammed into giving away important information that'll let others access their account. This article will teach you everything you need to know about Cash App's safety and security, the risks associated with using it, and how you can have a more secure Cash App experience.

Is It Safe To Make Payments With Cash App?

Yes, sending money with Cash App is safe if you adhere to specific exceptions we will discuss. To guarantee the safety of its users' money and personal data, Cash App combines encryption with automated fraud detection mechanisms. It encrypts customer data in transit to its servers and uses a fraud detection algorithm to detect fraudulent transactions.

It's also worth noting that Cash App complies with PCI DSS Level 1 of the Payment Card Industry Data Security Standard, meaning it complies with all applicable security requirements to reduce the risk to the Visa system. This security standard applies to any company that stores, processes or transmits credit or debit card and cardholder data. Because Cash App is Level 1 compliant (the highest level), it's certified to process over 6 million transactions annually securely.

That said, Cash App is not without its drawbacks and risks. In the following section, we'll go over the dangers of using Cash App.

Cash App Safety Risks

Payment apps are often targets of fraudsters who attempt to steal customer data by posing as customer service representatives. Cash App is no exception.

If anybody claiming to be a Cash App's customer service representative requests your sign-in code or PIN, requests money, or requests personal information, they are a fraudster. No Cash App customer service representative will ever request your sign-in code over the phone, social media, email, or any other channel.

Here is a list of the most popular scams to look out for:

#1 Flipping Cash

Sometimes scammers will tell you you have won a reward, but to claim the prize, you must send a certain amount. Never send money to anyone expecting to receive a larger payment in return. If someone promises you free money in exchange for sending them money, it is most likely a scam. Furthermore, Cash App will never ask a customer for money for any reason.

#2 Apartment Or Rental Deposit

Fraudsters often promise a product or service without showing proof that it actually exists. This includes promising you cheap apartments or offering you an apartment at a significantly lower rate than usual but requesting you to send a deposit before seeing the prospective rental. It's probably a scam if you can't verify who someone is or the legitimacy of what they're offering.

#3 Accidental Payment

Scammers may send you money by “accident” and then request that you return it to them. After you've returned the funds, the scammers will launch a payment dispute with their bank or credit card, meaning both you and their bank will reimburse them.

Don't ever send money to an unknown person, even if it appears to be a legitimate claim. Here is what to do if this happens:

- Return the money to the sender without creating a new payment. Or better yet, contact customer support and report such a transaction as a mistake. Here is how to refund a payment using Cash App.

- Decline any payment request the scammers make (anybody you do not know).

- If they continue requesting payment, block them. Here is how to block a sender or a requester.

- Take extra steps to make your account more secure. Change your Cash App password and enable Cash App Payment Verification Security Lock. Here are more extra measures to secure your account.

#4 Fake Cash App Friday Offers

Cash App holds sweepstakes every Friday where customers win cash rewards. However, dozens of bogus Cash App Friday promotions on social media platforms such as Instagram, Facebook, and others use the official Cash App Friday promotional hashtag (#CashAppFriday).

Scammers will set up fake raffles and then message users, asking them to send a few dollars through Cash App or share their Cash App login credentials in exchange for a chance to win. If you want to enter the official Cash App sweepstakes, make sure the link you enter is from the official Cash App Twitter profile, which has a blue check mark next to the username.

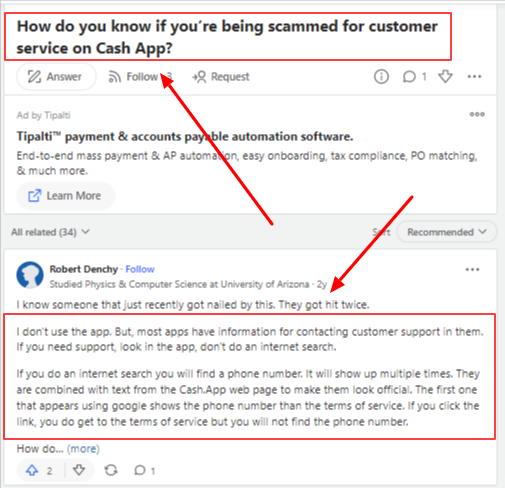

#5 Fake Cash App Support Numbers

Scammers may create bogus Cash App customer support accounts on social media or use SEO poisoning (search engine poisoning) to place fake websites with bogus “Cash App support” phone numbers at the top of Google search results. When a user clicks through and calls with a legitimate complaint or request, the scammer asks them for login information, allowing them to hijack and clear their funds. Always get the Cash App customer support number from Cash App official site.

How Does Cash App Work?

Cash App allows customers to pay or receive funds from other users who have linked a bank account, credit card, or debit card. You can also use Prepaid cards to add funds to Cash App, but you cannot transfer your Cash App balance to a prepaid card.

Cash App is similar to a traditional bank account in many ways. After signing up, Cash App will give you an account and routing number. So, you can make a cash deposit, set up paychecks direct deposit with your employer, and obtain a debit card (called a “Cash Card”). It's important to note that Cash App is a financial platform, not a bank. To provide banking services, the company collaborates with banks (like issuing debit cards and setting up direct deposits).

When you're ready to move funds from Cash App to your bank, you can do so via the app or browser. Standard deposits are free and typically take 1-3 days to process, whereas instant deposits cost 0.5% – 1.75% (minimum of $0.25) and get credited to your bank account immediately.

If you want to spend your Cash App balance paying for goods and services, you can do so with your Cash Card, both online and in-store. If you're buying from a Cash App merchant, you can open Cash App and scan the QR code on their point-of-sale system or website.

How To Sign Up For Cash App

Signing up for Cash App is super easy. Just follow these 5 simple steps:

- Download and install the app. Download the app for free from the Apple or Google Play stores and install it on your device.

- Provide your phone number. Cash App will request your phone number to send you a confirmation code. To get started, enter the code you received.

- Select your $Cashtag. To complete your profile, include a photo, $Cashtag, and email address.

- Sync up your bank accounts. Add a bank account, credit card, or debit card to send payments.

- Transfer and receive cash. Get your friends' $Cashtag, phone number, or email so you can send them money or request payments.

How To Avoid Scams On Cash App

Cash App has security measures to deter fraudsters from using their platform. Such measures include identity verification to access certain features, a fraud detection algorithm, and online safety tips to educate users.

Scammers, on the other hand, do not target their victims on Cash App but rather through other means, such as social media platforms and emails. These are outside of Cash App's control.

Fortunately, you can avoid becoming a scam victim simply by being a cautious and vigilant internet user. The following suggestions can assist you in this regard.

- Analyze the sender's email address: Although phishing scammers can replicate Cash App's email format, they cannot replicate email addresses. Cash App sends Emails to you from addresses that end in “@square.com,” “@squareup.com,” or “@cash.app.”

- Double-check your transactions before confirming: If you must use Cash App to transact with strangers, double-check the recipient's information. When the name they give you does not match the one on their Cash App account, this is a red flag. They could provide you with a false identity to conceal their true identity, which is highly suspicious.

- Enable payment confirmation and notification: You can configure Cash App's Security Lock to demand your passcode before each transaction. You can also enable notifications after every transaction to detect unauthorized transactions as soon as possible.

- Make your cash app account more secure: Cash App provides many ways to bolster your account's security to avoid becoming a scam victim. This includes security locks (PIN, Touch ID, or Face ID), enabling account notification, and multi-factor authentication.

So, Can I Trust Cash App?

Yes, you can trust the Cash App. We can conclude that Cash App is a reliable company that operates a legitimate payment processing business, has a secure transaction structure, and has a solid track record. So, you should not be concerned about using Cash App so long as you do your part to secure your account, avoid scams, and protect your personal information.

If you don’t already have a Cash App account, download the mobile app to sign up and get the $5 sign-up bonus.