If you choose to Invest IRA in gold to diversify your retirement portfolio, you should know that it can be challenging unless you know where to start. To start investing, you must find a reputable IRA custodian or gold IRA company to open a self-directed gold IRA, fill out all the paperwork, fund the new account, purchase your gold, and monitor the performance of your gold investments.

You can also invest in gold indirectly by buying gold through mutual funds, ETFs, or gold-producing companies. In either case, you must follow the specific rules and requirements given by the IRS, and you should invest in an asset that works according to your retirement goals, risk tolerance, and financial situation.

If you're considering purchasing physical gold coins and bars, you can only invest in IRS-approved, IRA-eligible gold and precious metals. Some examples include American Gold Eagle Coins, Canadian Gold Maple Leaf Coins, PAMP Suisse Gold Bar, and Credit Suisse Gold Bars. Once you chose your investment vehicle, we suggest choosing Augusta Precious Metals as your Gold IRA custodian. It's our best-rated gold IRA company.

If you've been thinking of investing in gold in your IRA, then you've come to the right place. For centuries, gold has proven to be a reliable alternative investment when the market doesn't flow our way, making us wonder if our stock investments are still worth keeping.

Keeping small shares of gold or storing physical gold seems like a good investment, but its risks and expensive fees may not be suitable for everyone.

That's why, in this guide, we'll introduce you to what an IRA is, how to invest IRA in gold, how to open your own gold IRA, the best ways to invest in gold, and the basic steps to get started.

What Is An IRA?

An Individual Retirement Account, commonly known as an IRA, is a savings account that individuals like you with earned income use to contribute to saving money for retirement. The amount of money you’re allowed to put into this account every year depends on your age and employment status.

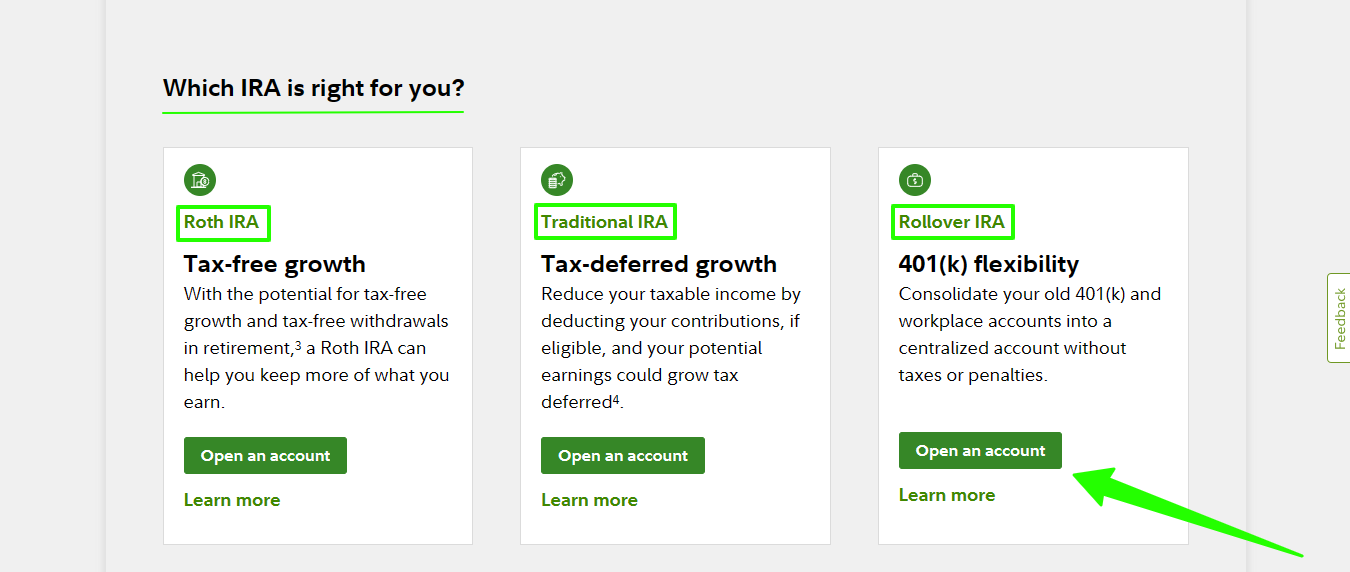

There are several types of IRAs, but the most common ones are Traditional IRAs, Roth IRAs, SEP IRAs, and SIMPLE IRAs. Let's explore its types and learn its age minimum, contribution limits, tax benefits, and if you're eligible for the account.

Each account type has its particular use case and pros and cons. Let’s compare them side-by-side.

| Age Minimum | Contribution Limit | Tax Benefit | Eligibility | |

| Traditional gold IRA | No minimum. | $6,500 ($7,500 if you’re 50 or older) | Tax-deductible contributions and your money grows tax-deferred | Anyone with earned income |

| Roth IRA | No minimum | $6,500 ($7,500 if you’re 50 or older) | Not tax-deductible but the contributions and withdrawals are tax-free | Income must be under $153,000 for individuals and $228,00 for married couples filing jointly |

| SEP IRA | At least 21 years old | The greater between 25% of your self-employed compensation or $66,000 | Tax-deductible contributions and your money grows tax-deferred | Individuals must have their own businesses or work for themselves. It has higher contribution limits than Traditional IRAs. |

| Savings Incentive Match Plan for Employees (SIMPLE) IRA | No minimum | $15,500 ($19,000 if you’re 50 or older) | Tax-deductible contributions and your money grows tax-deferred | Designed for small businesses owners with 100 or fewer employees |

What Is A Gold IRA?

A gold IRA is a special type of individual retirement account that allows you to own physical gold or other precious metals as part of your retirement savings. A gold IRA is different from a regular IRA, which only allows investors to hold traditional investments like stocks, bonds, or mutual funds. A gold IRA requires a special custodian or broker to buy, sell, and store the gold or other metals for the investor.

How Does Investing IRA In Gold Work?

Investing IRA in gold works in two ways:

- You can invest in physical gold through a gold IRA, or

- You can invest in paper gold through ETFs or mutual funds.

Putting your retirement funds in physical gold involves purchasing actual gold bullion and storing it in an IRS-approved depository through a gold IRA. Paper gold investments, on the other hand, refer to buying shares of gold-mining companies or ETFs that invest in those companies. While it’s not exactly the same as investing in gold directly, these assets tend to perform similarly to real physical gold.

How To Open A Gold IRA To Buy Physical Gold

If you're considering opening a gold IRA to buy your first gold bullion, you must take your time to choose a suitable custodian to work with. You can check out our list of the best gold IRA custodians to compare each option’s special features.

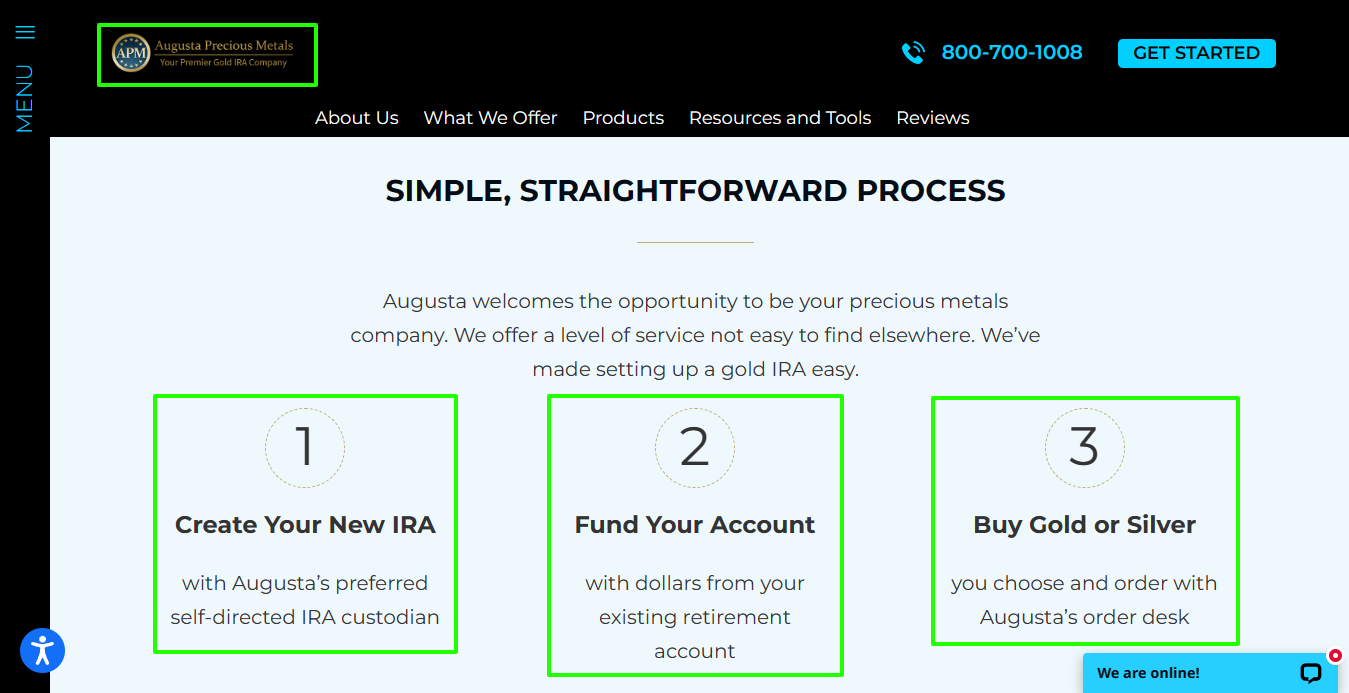

Let’s take Augusta Precious Metals, our top-rated gold IRA company, as an example to explain how to open a gold IRA to buy your physical gold.

The process is straightforward. After choosing your preferred gold IRA custodian, you only need to reach out to its customer support team that’ll help you:

- Create an account

- Fund your account either with new contributions of with savings from another retirement account, and

- Purchase your gold.

The company will assist you in storing your gold in an IRS-approved depository, or, in special cases, you may be able to store your gold at home.

Buying physical gold in an IRA might seem attractive to maximize your portfolio's growth. However, these assets can be more expensive and can provide lower yields compared to mutual funds and ETFs—this makes gold IRAs a more suitable investment for diversification and hedging against inflation than for growth.

Self-Directed IRA Eligible Gold Coins And Bars

You can’t store just any type of gold in a gold IRA. There’s a very specific set of gold investments to choose from. Self-directed IRA gold coins and bars are physical gold you can hold in a self-directed IRA. These gold bullion can be considered eligible for a self-directed IRA if they meet specific criteria set by the IRS. Some examples of IRS-approved gold for gold IRAs include:

#1 Gold Coins

Gold coins are usually produced by government and private mints that come in various sizes ranging from 1/10 to 1 ounce or more. They’re also typically made of 22-karat or 24-karat gold with iconic designs or historical figures. All coins minted by government-sponsored mints, like the US Mint, are eligible for gold IRAs. Otherwise, coins must be at least 99.5% pure gold to be considered IRA-eligible.

Some of the most popular IRA-eligible gold coins you can purchase include the American Gold Eagle, the Canadian Gold Maple Leaf, and the South African Krugerrand.

#2 Gold Bars

Gold bars are a block of gold produced by private companies and government mints. They also come in various sizes, ranging from 1 ounce to 1 kilogram or more, and have at least 99.5% purity.

Some investors prefer gold bars over coins since they are more cost-effective and they can get more gold for their money. However, these bars aren't as liquid as coins because of their higher mass. If this isn’t an issue for you, you can purchase gold bars instead of coins.

Some IRA-eligible gold bars include the PAMP Suisse Gold Bar, Credit Suisse Gold Bars, and Johnson Matthey Gold Bars.

Benefits Of Buying Physical Gold In An IRA

There are many reasons why buying physical gold in your IRA can be beneficial, especially for your retirement. One of the reasons that lead most investors to put their money in this asset is diversification.

Physical gold correlates negatively to the stock market, so when markets go down, gold goes up. This provides protection against economic downturns and is therefore a great means of diversification.

Other benefits include:

- Gold is a hedge against inflation.

- Protection from economic crises.

- An asset that can be passed down to future generations.

In principle, you can invest as much or as little in gold as you want. However, if you’re investing in a gold IRA, you must keep within your annual contribution limit, which is $6,500 if you’re young, or $7,500 if you're 50 or older.

How To Buy Gold In An IRA: A Step-By-Step Guide

Buying gold in an IRA can be challenging if it’s your first time. The first decision to make is whether you're buying paper gold or physical gold for your retirement portfolio since you’ll need different

#1 Find A Reputable Self-Directed IRA Custodian

The first step to buying paper gold in an IRA is to find a reputable self-directed IRA custodian you can trust to manage your gold investments. You must choose a gold IRA custodian if you want to invest in physical gold.

There are hundreds of gold IRA custodians out there, but only a few notable ones are worth your retirement funds and time. We did the heavy lifting for you and compared dozens of options in our post about the best gold IRA companies. One of the best gold IRA custodians is Augusta Precious Metals, which has an A+ rating on BBB and offers a wide range of gold and other precious metals investments for every type of investor.

If you don’t intend to invest in physical gold, you can choose a normal self-directed IRA.

Once you choose your custodian, it can help you handle the process of rolling over your funds into your new gold IRA directly.

#2 Open A Gold IRA

After you choose an IRA custodian, you'll be guided by your custodian to open a gold IRA. This standard account opening procedure will require you to fill out some paperwork and provide personal information to verify your account.

#3 Request A Direct Rollover (For Physical Gold Investors)

After opening your new gold IRA, you must fund it by transferring your existing funds to your IRA. When you receive your funds, you can now purchase which gold investment you want to hold.

To invest in physical gold, you must transfer your retirement funds into your gold IRA by requesting a direct rollover from your 401(k) or other existing retirement account administrator. This is to avoid paying withdrawal penalties to the IRS. You can do an indirect rollover yourself, but it’s risky.

You’ll probably have to wait for at least 1 to 3 weeks for the transfer to be completed, and you're limited to only one IRA-IRA rollover in any 12 months.

If you chose to invest in paper gold from mutual funds or ETFs, this step is not required since you can invest in these assets directly from a normal retirement account.

#4 Purchase Your Gold

Once your gold IRA is funded, you can purchase your gold investments. Remember that if you choose to purchase physical gold, there are specific requirements that you should follow. For example, your gold must be produced by a government or private mint with a minimum purity of 99.5%.

#5 Store Your Gold (For Physical Gold Investors)

After purchasing your IRS-approved gold bars or coins, you must store them in a third-party facility like Brink's Security Company or Delaware Depository. Although some custodians offer home storage for your gold investments, it's not recommended since it could be subject to theft. Additionally, you’ll incur heavy fees if you don’t follow the IRS’s stringent rules for home storage gold IRAs.

#6 Monitor Your Investment

Whether you purchase paper gold assets or actual gold, you’re still responsible for monitoring your investments from time to time. Gold can still be volatile even though it has a low negative correlation with the stock market, so you must check its performance and make necessary adjustments to ensure your portfolio is on the right track.

Best Ways To Invest In Gold In IRA: ETFs, Mutual Funds, And Gold IRAs

Gold ETFs

A Gold ETF, or a gold exchange-traded fund, is an investment option that invests in gold-producing company stocks, futures contracts, or physical gold that the fund owns. ETFs are traded on an exchange like stocks, which can be actively bought and sold throughout the day. It's a popular choice for individuals looking to invest in gold without purchasing and storing it. This is also a good choice if you're interested in gaining exposure to gold while having the convenience of letting a professional handle your account.

To invest in gold through ETFs in an IRA, you'll need to open a self-directed IRA with a custodian that allows you to put your retirement funds in this type of asset. Once you've opened the account, you can buy shares of gold ETFs from a broker.

You don't have to check your account regularly since a fund manager will take care of that. However, you must remember that your ETF's value depends on the price of gold. Thus, it's crucial to find an experienced company to manage your account, like SPDR Gold Shares (GLD) or Aberdeen Standard Physical Gold Shares ETF (SGOL).

Gold Mutual Funds

Gold mutual funds are another way to invest gold in an IRA. These investment vehicles work similarly to ETFs, but the key difference is that they are bought and sold once per day through gold mutual fund companies. This option might be for you if you want less volatility in your investment since they’re priced at the end of the trading day. If you're willing to pay higher fees in exchange for higher returns and more diversified gold exposure, you might consider this more than a gold ETF.

If you're looking for a gold mutual fund company, you can start with Allspring Precious Metals Fund (EKWAX), VanEck International Investors Gold Fund (INIVX), and Gabelli Gold Fund (GLDAX) to ensure that you're putting your money into a secured and reputable institution.

Physical Gold Through Gold IRA

Physical gold is the third best way to invest in gold in an IRA. This type of gold refers to actual gold bars or coins you can purchase and store in a secured facility. Unlike mutual funds or ETFs, you can personally visit or hold your gold investments in a gold IRA custodian and pass them to your grandchildren for future use.

Investing in physical gold in an IRA can only be done through a gold IRA company. This process involves setting up an account with a custodian that offers gold IRAs as explained above. This incurs costs like storage and account maintenance fees to ensure your assets are kept safe and in good hands.

Although physical gold provides a hedge against inflation during your retirement, you should know that keeping these assets can be expensive to maintain, and their value depends on their price, which can be as unpredictable as stocks.

How To Sell Your Physical Gold In An IRA

To sell your physical gold held in an IRA, you must follow these steps to ensure your transactions go smoothly.

- Contact your gold IRA custodian to let them know you want to sell your gold.

- Follow the instructions and fill out the necessary paperwork provided by your custodian. These may include the type of gold you're selling and the dealer you'll trade it with. Some custodians offer buyback programs to purchase your gold back from you at competitive prices.

- Complete the paperwork, be ready to deliver your gold to the dealer, and ensure its shipping address and other essential details are correct.

- Once your dealer receives your gold, they will verify its value and authenticity. If confirmed, they'll send you the payment for your gold directly to your gold IRA.

It’s important to note that selling gold from a gold IRA counts as making a withdrawal and will be subject to an IRS early withdrawal penalty fee of 10% if you’re under 59 ½. Also, if you reach retirement, this is how you take distributions from your gold IRA account.

In Summary

Investing in gold through an IRA can be used to take advantage of its tax benefits and diversify your retirement portfolio to protect against inflation and economic downturns. Whether you want to put your funds in paper gold assets like stocks, mutual funds, or ETFs, or in physical gold, it involves opening an account with a self-directed IRA custodian. Once you have that, you just need to fund your account and use the funds to buy your gold.

Overall, investing in gold for your IRA can be a smart move to maximize your profits; you must be aware of the fees, rules, and regulations set by the IRS to avoid any tax penalties that would lead to further complications.

Invest In IRA In Gold FAQs

Is gold a good IRA investment?

Yes, gold can be a good IRA investment. Investing in gold can have potential benefits for your retirement, such as tax advantages, inflation hedges, and diversification. However, this type of investment might not be for you since it has higher fees than other IRAs and can be volatile when the price of gold decreases.

Can I buy physical gold for my IRA?

Yes, you can buy physical gold for your IRA. You can purchase actual gold by rolling over your 401(k) or existing IRA funds to a gold IRA. Once you fund your account, you can buy any gold product you like as long as it meets the purity standards of the IRS.

How do I start a gold IRA?

Starting a gold IRA involves a few key steps. First, you need to choose a reputable gold IRA company to work with. They will help you open the account, transfer funds, purchase your metals, and ensure your gold is shipped to an approved depository for storage. Next, you'll need to set up a self-directed IRA, which gives you more control over your investment choices.

You can choose to invest in physical gold, gold ETFs, or other gold-related assets. Once your account is funded, you can purchase your gold. Make sure to choose gold that meets the IRS requirements for purity and storage. Finally, your gold must be stored in an approved depository. Your gold IRA company can help you choose a depository and arrange for storage.

Where do you store IRA gold?

You can store your IRA gold in an IRS-approved depository like Brinks Security Company or Delaware Depository. If you prefer other third-party facilities, your custodian will give you additional recommendations on where to store your gold. You can also keep your physical gold at home, but the custodian doesn't recommend this storage option since it comes with risks and higher fees.

How much of my IRA should be in gold?

The amount that you should invest in your IRA in gold depends on your retirement goals, risk tolerance, and financial lifestyle. Experts recommend that you should at least invest 5 to 10% of your portfolio in gold, but you can go lower or higher depending on your plan and budget. Nevertheless, you should talk to your financial advisor or fellow investors before making any investment decisions.