Having gold in a Roth IRA can be a smart move to diversify your portfolio and potentially earn a tax-free retirement income. Although gold can provide a barrier against inflation and a legacy for your grandchildren, investing in gold can come with special fees and costs that may not be suitable if you’re a small and novice investor.

Thus, I recommend investing in gold mutual funds first, like Gabelli Gold Fund (GLDAX), for beginner investors who’d like to diversify their portfolio with gold, like Gabelli Gold Fund (GLDAX). As of writing, this fund has over $361 million in assets and spends 80% or more of its total assets on U.S. domestic and foreign-issued equity securities related to gold. This provides more opportunities to earn higher returns than investing in gold directly.

If you’re not keen on investing in paper assets but are looking to buy tangible, physical gold, you can do so with a gold IRA. If you’re looking for tax-free income during retirement, you can choose a Roth Gold IRA, which is funded with after-tax dollars. All it takes is opening a self-directed Roth gold IRA account with a reputable custodian like Augusta Precious Metals, our #1 best-rated gold IRA company.

There are plenty of reasons why you’d want to invest gold in a Roth IRA. Perhaps you want to protect your retirement savings from an unexpected economic crisis or inflation. Maybe you’re looking for a tangible asset to diversify your income portfolio. Or maybe you want to take advantage of its tax benefits, where you can make withdrawals tax-free.

Regardless of your reasons, investing gold in a Roth gold IRA is easy, but it has many rules to follow to avoid tax penalties along the way. In this post, we’ll delve into the details of the Roth gold IRA, how it works, its rules and regulations, its pros and cons, and the best ways to invest in this type of retirement account.

What Is A Roth Gold IRA?

A Roth gold IRA is a type of individual retirement account (IRA) that allows you to save money for retirement by investing in physical gold or other precious metals. These metals could be IRS-approved silver, platinum, palladium, and, of course, gold. However, not all gold IRA custodians allow you to invest in precious metals other than gold.

A Roth gold IRA works just like a normal Roth IRA. You contribute part of your income with after-tax dollars or money you’ve already paid taxes on, so your investment grows tax-free. Thus, when you retire or when you reach 59 ½, you can withdraw the money you make without paying taxes on your distributions.

It’s important to note that there’s a difference between this type of IRA and a normal Roth IRA. For example, you can’t invest in gold directly in most Roth IRAs; if you have a Roth IRA and want to invest in gold, you must convert your Roth IRA into a self-directed Roth gold IRA.

Precious Metals Roth IRA

Unlike traditional IRAs, a precious metals Roth IRA allows you to invest your retirement funds in physical gold and other precious metals.

Once you have created and funded your account with an IRA custodian, you can purchase the type and amount of metals you want to invest in. Then your custodian will buy it and store it in a secured storage facility.

If you want to learn more about gold in Roth IRA and the best ways to invest, keep reading for more!

How Does A Roth Gold IRA Work?

A Roth gold IRA works very similarly to a normal Roth IRA. It has the same contribution limits and withdrawal requirements as a regular Roth IRA but requires a special custodian or broker to hold and store the physical metals for you. A Roth gold IRA offers the benefit of tax-free retirement withdrawals and the potential hedge against inflation and market volatility since it lets you invest in gold with after-tax dollars. However, a Roth gold IRA also involves higher fees, stricter rules, and more risks than a regular Roth IRA.

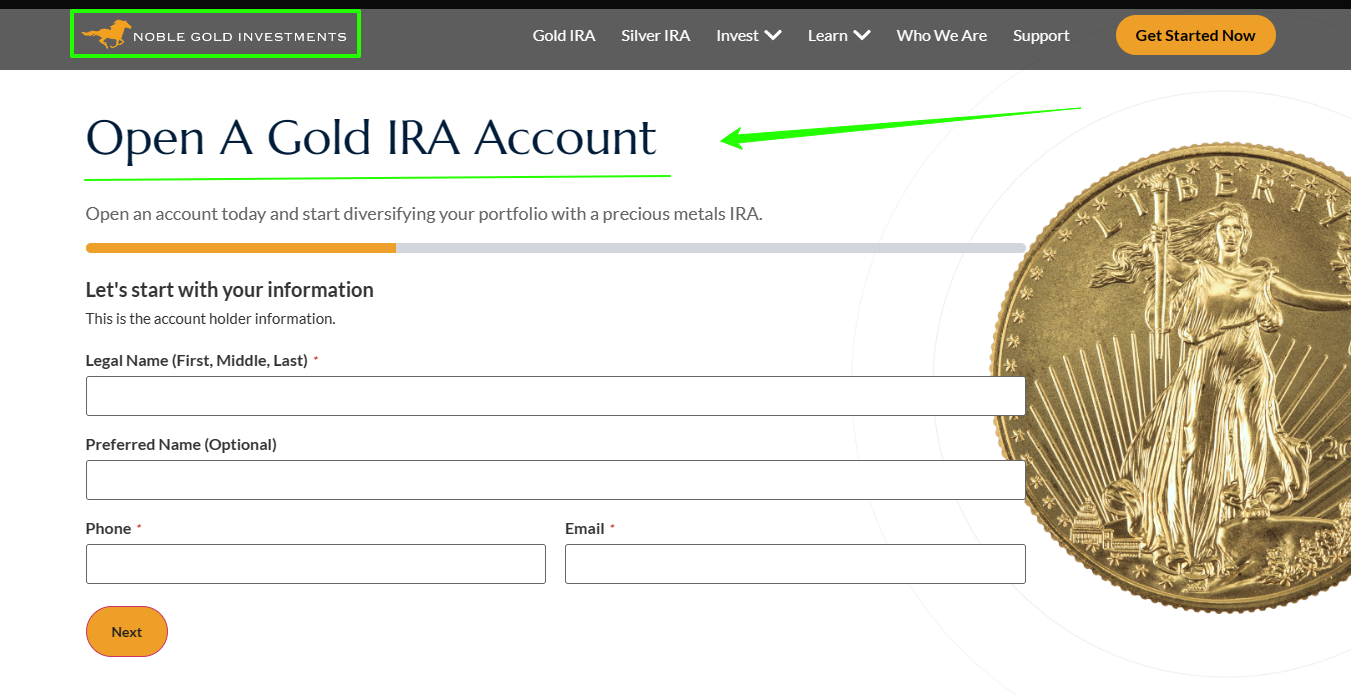

The first step to investing in a Roth gold IRA is selecting a self-directed IRA custodian that allows you to invest in gold, like Augusta Precious Metals, for example-

Traditional Gold IRA Vs. Roth Gold IRA

If all this talk about different types of IRAs has you confused, don’t worry; we’ll break it down for you. There are several types of normal IRAs that don’t let you invest in physical gold, and there are also a set of different gold IRAs which do.

Two popular gold IRAs are Traditional gold IRAs and Roth gold IRAs. The following table summarizes these two types of retirement accounts’ differences and similarities.

| Traditional Gold IRA | Roth Gold IRA | |

| Best For | Individuals looking to diversify their portfolio with gold and other precious metals with tax benefits. | Individuals looking to invest in gold and take advantage of tax-free growth and tax-free withdrawals in retirement. |

| Tax Benefits | Traditional gold IRAs are just like normal traditional IRAs in that contributions are tax-deductible and tax-deferred. | Tax-free growth and tax-free withdrawals You may qualify for the Retirement Savings Contribution Credit for additional tax credits of 10%, 20%, or 50% |

| Contribution Limits | $6,500, or $7,500 if you’re 50 or older | $6,500, or $7,500 if you’re 50 or older |

| Distribution Limits | Traditional gold IRAs require minimum distributions at age 72 | Roth gold IRAs do not require minimum distributions. |

Roth Gold IRA Rules And Regulations

There are important rules and regulations you need to be aware of before you invest your money in a Roth Gold IRA.

These rules are:

- You can contribute to your account even after you reach age 70 ½.

- You need to convert or roll over your Roth IRA to a Roth gold IRA so you won’t be subject to a 28% collectible tax rate and can invest in gold without penalties.

- You can’t use your contributions to deduct taxable income in a Roth gold IRA.

- You don’t have to take distributions regardless of age if you’re the account’s original owner, unlike traditional IRAs that require you to withdraw by age 72.

- Your qualified distributions are tax-free if your Roth gold IRA has been active for at least 5 years; otherwise, you’ll be subject to a 10% early withdrawal fee.

- If you are single and have over $153,000 of adjusted gross income (AGI), you won’t be able to contribute to the account.

If you have other questions in mind, you can visit the official page of the IRS here.

Contribution Limits Of Roth Gold IRA

Although a Roth gold IRA offers tax advantages and an alternative investment to gold, you should know there are limits to how much you can contribute to your account each year. You also must understand that the IRS sets these limits, which can be changed yearly. So let’s explore the current IRA contribution this year and see if they work with your financial plan.

| Age Limit | Contribution Limit 2023 | Contribution Limit 2023 |

| No age limit for contributions and distributions | $6,000, or $7,000 if you’re age 50 or older | $6,500, or $7,500 if you’re age 50 or older |

Note that if you contributed more than your limit, you might be taxed at 6% each year for the excess amount in your Roth IRA. To avoid the penalties, you must withdraw the excess contributions by the due date of your income tax return (ITR). So, it’s best to avoid over-contributing in the first place.

Holding Gold In An IRA: Mutual Funds & ETFs

Gold has been considered a safe haven investment for decades, especially when global events shake the stability of the stock market. However, normal Roth IRAs can’t hold physical gold as an investment. If you want to strengthen your retirement portfolio with gold in a normal Roth IRA, you’ll have to choose an asset class that tracks the price of gold, like gold mutual funds and ETFs.

Mutual Funds

Mutual funds are one way to gain gold exposure in a Roth IRA. These funds invest in gold-related assets such as gold mining company stocks and gold futures contracts. One of the best gold mutual funds you can invest in is Allspring Precious Metals Fund which gained 12.79% over the past 3 years.

If you’d like to invest in a gold mutual fund, you have to choose how you would like it to be managed; these are:

Actively managed funds

Actively managed funds are handled by professional fund managers who aim to surpass the stock market by choosing the best gold-related assets based on their research and analysis. For example, Gabelli Gold Fund (GLDAX) is one of the best actively managed funds in the U.S., focusing on long-term appreciation in gold and other precious metals securities.

Note that this fund has higher fees since they have to be supervised regularly to ensure you’ll get higher returns whenever you want to sell your shares.

Passively managed funds

Passively managed funds are also handled by a fund manager focusing on buying and selling the same assets and proportion of the index fund it tracks, like the S&P 500 and Nasdaq Composite. Unlike actively managed mutual funds, its fund managers don’t delve much deeper into selecting the best gold companies to invest in. Instead, they rely on the index fund’s properties.

This type of fund also tends to have lower fees because they require less management. However, they may not offer higher returns since it doesn’t aim to outperform the market as actively managed funds do.

ETFs

An ETF or exchange-traded fund is a type of investment vehicle that can hold gold-related assets such as gold bullion, shares of gold mining companies, or futures contracts that are traded on a stock exchange. When you buy a share of a gold ETF, you are primarily purchasing a share of the gold held by the fund manager— either it’s invested in a gold company’s shares or in a company that stores physical gold bullion like the SPDR Gold Shares ETF (GLD).

There are several benefits if you invest gold in ETFs rather than mutual funds. These are lower expense ratios, trading flexibility, and lower investment minimums (can be purchased by share).

Pros & Cons Of Roth Gold IRA

A Roth gold IRA can provide several potential benefits, including tax advantages and portfolio diversification. However, there are pros and cons when you try investing in precious metals. Let’s look at the advantages and disadvantages of this investment vehicle, so you’ll know if a Roth gold IRA is suitable for you.

Roth Gold IRA Pros

- No minimum distribution – Roth gold IRAs do not require any minimum distributions, unlike the traditional IRAs that need you to take a distribution when you turn 72.

- Ability to control – having a Roth gold IRA allows you to decide which gold assets you want to include in your retirement portfolio—allowing you more control over your investment strategy and performance.

- Inflation Hedge – the value of gold tends to rise when the purchasing power of currency decreases, thus making it an attractive investment during periods of inflation.

- Estate planning benefits – transferring your gold assets to your beneficiaries can be tax-free, especially if you meet the requirements for tax-free distributions.

- Protection against market downfalls – since gold has a low correlation with the stock market, thus you can use gold as an alternative investment to protect your retirement savings from economic uncertainty.

Roth Gold IRA Cons

- Fees and storage costs – investing in a Roth gold IRA can come with expensive fees such as maintenance, transaction, and storage fees—which may not be suitable if you’re a beginner investor.

- Lack of transparency – some gold IRA companies do not show their fees and costs on their website when you create an account with them, and they also tend to make more money by charging you more than the actual price of gold displayed on metal exchanges like COMEX.

- Rules and regulations – you must follow the IRS rules and regulations when you want to invest in gold to avoid any tax penalties. For example, your physical gold and silver must be at least 0.995 and 0.999, respectively.

Overall, investing in a gold Roth IRA should be considered carefully to avoid the potential downsides, such as fees for purchasing and storing physical gold. That’s why I recommend consulting your financial advisor and asking for advice about whether this investment option suits your retirement.

Can You Buy Gold In A Roth IRA?

Yes, you can buy gold in a Roth IRA, either in paper gold or in physical form. If you wish to purchase gold with shares, you can invest in mutual funds or ETFs in gold mining companies. Moreover, if you want to own actual gold, you have to roll over your Roth IRA to a gold IRA with a custodian. After that, your Roth IRA will transfer your funds to the IRA custodian to purchase physical gold.

Can I Buy Gold ETF In A Roth IRA?

Yes, you can buy gold through ETFs in a Roth IRA. Investing gold in an ETF allows you to purchase shares and follow the prices of gold to avoid the storage requirements of physical gold. You can invest in a gold ETF directly through an online brokerage or stock exchange.

Can I Invest In Gold and Silver In Roth IRA?

Yes, you can invest in gold and silver in a Roth IRA as long as you know the risks and the fees for holding precious metals in your account, especially if it’s in a mutual fund or ETF. Moreover, you can also invest in physical gold and silver as long as it meets certain purity standards like gold being at least 99.5% pure and silver being at least 99.9% pure.

In Summary

A Roth gold IRA is an individual retirement account (IRA) that allows you to invest in gold-related assets like gold mutual funds or ETFs or your own physical gold bullion by doing the gold IRA rollover process. You have to follow rules to have a Roth gold IRA, including contribution limits, gold IRA rollovers, and a minimum 5-year holding period to avoid tax penalties.

Furthermore, investing in a precious metal roth IRA can benefit young adults and people near retirement as it can provide a source of tax-free retirement income that can hedge against inflation—producing a gift of inheritance for future generations.

Gold In Roth IRA FAQs

Is gold in Roth IRA worth it?

Yes, using a gold Roth IRA is worth it. A Roth IRA can provide several benefits, including tax advantages like tax-free withdrawals, the ability to control your investments, hedge against inflation, and protection to build your wealth in the long run.

Can I buy gold with my IRA?

Yes, you can put gold in your Roth IRA by investing in gold ETFs or mutual funds. This approach prevents you from paying any potential tax penalties since you can’t invest in gold and/or silver in a Roth IRA directly.

How do I set up a gold Roth IRA?

To set up a gold Roth IRA, you must open a Roth IRA with a self-directed IRA custodian. After that, you can fund your new account with your existing IRA or 401(k) plan. Once the transfer is complete, you can purchase gold through ETFs or mutual funds that invest in gold mining companies.

Suppose you want to set up a gold Roth IRA to invest in physical gold; you must convert your Roth IRA to a gold IRA. This process involves choosing an IRA custodian that allows physical gold investments, which will use your Roth IRA funds to purchase gold bullion.

Should you hold gold in a Roth IRA?

Yes, you should hold gold in your Roth IRA, but it depends on your risk tolerance and retirement goals. Having gold in your account can offer tax benefits, generational wealth, and diversification. However, it can also be costly if you invest in physical gold, as you may need to pay for storage, maintenance, and transaction fees.

Can you hold a gold ETF in a Roth IRA?

Yes, you can hold a gold ETF in a Roth IRA. This can be a great choice if you want to gain exposure to the price of gold without physically owning one. You can start investing in a gold ETF through a stock exchange or brokerage, but be aware of the expenses it can come with, such as expense ratio and brokerage fees.