Day trading platforms give investors the opportunity to lock in short-term profits before the trading day ends. They're designed to be fast and easy to use, but also powerful enough to make more complex trades so you can capitalize on market movements in real time.

After reviewing dozens of day trading platforms, we recommend Qtrade as the best broker for experienced investors. With zero minimums, access to over 150 stock exchanges worldwide, and a highly-rated app, I'm confident Qtrade is the best day trading platform in Canada today.

What Is Day Trading?

A day trade is when an investor buys and sells a financial instrument on the same day. The objective of this technique is to take advantage of daily price fluctuations to make large short-term profits. In this sense, it's the opposite of long-term investing in assets like commodities or real estate.

Day trading has a variety of risks and rewards, depending on the trading strategy. Scalping, fading, and momentum are just a few popular trading strategies. Professional day traders are very familiar with charts and research and are committed to sticking to their strategy. New investors may struggle with this concept and will likely have to resort to investment newsletters like Capitalist Exploits to get good investment advice.

As usual, the goal of day traders is to buy low and sell high, which entails profiting from rapid changes in the stock or bond markets. While this may appear simple, it requires a great deal of skill and knowledge to accomplish.

Benefits Of Day Trading

When day trading is done successfully, it has the potential for enormous profits in a very short time frame – plenty of very experienced traders have accomplished this, which makes day trading an attractive option for many entering the space. However, most don't mention that successful day traders usually have years and years of experience and knowledge and already know the how-tos of the business.

Whether you're an experienced trader or just getting started, day trading is a difficult and high-risk type of investment. Day trading isn't for the faint of heart – it requires minute-by-minute decision-making, as well as leveraged investment techniques that can result in significant losses if used incorrectly.

We don't particularly like day trading, but if you think you're ready and that it is the right investment for you, here are the best day trading platforms Canada has to offer.

The 7 Best Day Trading Platforms In Canada

#1 Qtrade Investors

| Minimum Balance | $0. No account minimums. |

| Monthly Fees | $25 or, $0 (if the balance is over $25,000). |

| Standard Trading Fees | Stocks: $8.95 per trade. ETFs: $8.95 per trade. Options: $8.95 + $1.25 per contract. |

| Active Trader Fees (over 150 trades per quarter) | Stocks: $6.95 per trade. ETFs: $6.95 per trade. Options: $6.95 + $1.25 per contract. Includes trading tools |

Qtrade is, without a doubt, the best day trading platform in Canada. It’s been around for more than 20 years, and is currently offering a $50 signup bonus for new users.

Qtrade is owned and operated by major independent wealth management company Aviso Wealth, and it is currently the best online broker for day trading in Canada. Qtrade offers advanced research tools and has the lowest fees in Canada.

If you're an experienced investor, you can sign up for their paid subscription, Investor Plus, and access preferential commissions. You will also qualify – for free – if you have more than $500,000 in assets or if you completed more than 150 transactions in the last quarter.

There's a quarterly fee of $25, waived if you have over $25,000 in assets or you've completed at least two transactions during the previous quarter.

With Qtrade Investors, you can buy and sell US and Canada-based ETFs, with no commissions. The only requirement is that the order is worth at least $1,000 and that you hold the ETF for at least a day. That last one is not particularly attractive for a day trading platform, but there are better options than ETFs if you're planning to day trade. I’ve personally used Qtrade for years, and I can’t recommend it highly enough.

#2 Questrade

| Minimum Balance | $1,000 |

| Monthly Fees | $0 Basic plan. $19.95 Enhanced plan (Includes trading tools). $89.95 Advanced Canadian Data Package (Includes trading tools). |

| Fixed Fees | Stocks: $4.95 per trade. ETFs: $4.95 per trade. Options: $4.95 + $0.75 per contract. |

| Tiered Fees | Stocks: $0.01-$6.95 per trade. ETFs: $0.01-$6.95 per trade. Options: $6.95 + $0.75 per contract. |

Questrade has been operating for over 20 years and is one of Canada's oldest online trading platforms. Unlike Qtrade, Questrade has a $1,000 minimum account balance requirement. It offers low fees, and it's best for large caps trading and options trading.

The standard price to trade stocks at Questrade is $0.01 per share, and there's a minimum per trade of $4.95 and a maximum of $9.95. Options trading fees are $9.95 + $1 per contract.

Questrade offers three different research tools and data packages and allows you to purchase individual add-ons if none of their packages work for you. Currently, there are three basic brokerage account packages: Basic ($0), Enhanced ($19.95), and the Advanced Canada data package ($89.95).

Subscribing to any Canadian data package automatically applies active trader pricing to all your transactions.

Additionally, if you earn a total commission of $399.95 or more in a month, you'll receive a rebate of $89.95 and effectively pay nothing for the Advanced Canada Data Market package.

#3 TD Direct Investing

| Monthly Fees | $25 ($0 if balance over $15,000) |

| Standard Trading Fees | Stocks: $9.99 per trade. Options: $9.99 + $1.25 per contract. |

| Active Trader Fees (over 150 trades per quarter) | Stocks: 7.00 per trade. Options: $7.00 + $1.25 per contract. Includes trading tools. |

TD Direct Investing is a registered Canadian-based online trading platform part of the TD Bank Group. It offers a sophisticated international trading platform for Canadian investors to trade securities listed on the US and the Toronto Stock Exchange.

TD Direct Investing offers three distinct trading platforms to individual investors: WebBroker, the TD mobile app, and the Advanced Dashboard. The Advanced Dashboard is for active traders who want access to analytics, charts, and various research tools.

The fee for trading Canadian equities is $9.99, and the fees for options are $9.99 + $1.25 per contract. Unlike most online trading platforms, mutual funds and select ETFs have no trading commissions.

To be eligible for active trader pricing, you must have made at least 150 transactions on the TD Direct investing trading platform in the previous quarter; for active traders, the fees drop to $7.00 for stocks and $7.00 + $1.25 for options.

Other costs include quarterly account maintenance fees of $25 for an account balance of less than $15,000 and market data fees.

#4 Wealthsimple Trade

| Monthly Fees | $0 or, $3 Trade Premium Plan |

| Trading Fees When Buying | Stocks: $0. ETFs: $0. |

| Trading Fees When Selling | Stocks: $4.95-$9.95 per trade. ETFs: $4.95 per trade. |

Wealthsimple Trade is one of the most well-known trading platforms in Canada.

This online broker is owned by the popular robo advisor Wealthsimple, and it is great if you are looking for commission-free trading of stocks and ETFs.

The Wealthsimple trading platform is user-friendly, and it's available on Wealthsimple's webpage and mobile. There are no fees associated with buying stocks or ETFs; however, there is a flat fee when selling either – $4.95 per trade.

Another consideration is that you get delayed price updates for equities for free accounts, which can prove significant for day traders. If you want real-time market data on the Canadian stock market, you can get Trade Premium for $3 per month.

#5 CIBC Investor's Edge

| Standard Trading Fees | Stocks: $6.95 per trade. ETFs: $6.95 per trade. Options: $6.95 + $1.25 per contract. |

| Active Trader Fees | Stocks: $4.95 per trade. ETFs: $4.95 per trade. Options: $4.95 + $1.25 per contract. Includes trading tools. |

| Student Fees | Stocks: $5.95 per trade. ETFs: $5.95 per trade. Options: $5.95 + $1.25 per contract. |

CIBC Investor's Edge is one of the best day trading platforms in Canada – for new investors. Owned by CIBC, it primarily offers stock trading, mutual funds trading, and options trading. It also caters to those looking to invest in mutual funds, GICs, precious metals, and government bonds. It also allows you to trade international stocks.

CIBC Investor's Edge is available as a mobile app and is perfect for traders looking for online stock brokers that offer lots of research tools, including technical analysis and stock screenings.

Like other online brokers and trading platforms on this list, they offer special pricing for active traders and a quarterly rebate on some fees. Students also get a $1 rebate, which drops the standard fee from $6.95 per trade for stocks and ETFs to $5.95.

#6 CI Direct Trading

| Fees | The account minimum is $1,000. 14-day demo account available. $1.99-7.99 fee per trade $24.95 inactivity fee per quarter. No annual fees. |

| Features | Reduced fees for active traders (over 150 trades). Mobile App (Rated 4.5/5 on the App Store). Includes trading tools. |

| Accounts | Bank and brokerage accounts. |

CI Direct Trading platform is a CI Investment Services Inc. division and a popular stock trading platform. Traders that make more than 150 trades each quarter are charged a $3.00/trade flat fee. The minimum is $0.01 per share or at least $1.99 per trade, with a maximum of $7.99 per trade if you sell an ETF. CI Direct Investing is recommended for experienced and active traders familiar with the Toronto stock exchange and international trading.

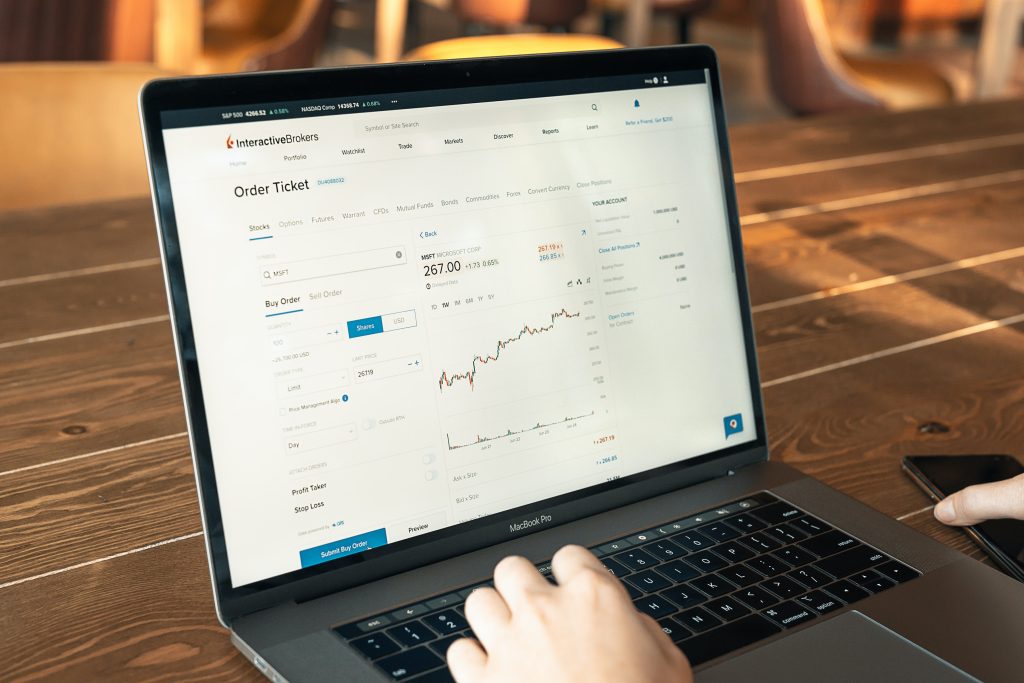

#7 Interactive Brokers

| Minimum Balance | $0. No account minimums. |

| Monthly Fees (only one applies) | $10 fee for monthly balances over $2,000. $20 fee for monthly balance below $2,000. $3 (clients that are 25 years old or less) |

| Trading Fees | Fixed pricing $0.01 per share (max 0.5% of trade). Tiered pricing (lowest is $0.008 per share). |

Interactive Brokers is one of the best trading platforms in Canada. It offers stocks trading with very low fees, no minimum deposits or balances, and exposure to international stocks.

Interactive Brokers provides day traders access to 150 exchanges in 35 countries and trading in 25 currencies. In addition, Interactive Brokers is the only online brokerage that supports fractional share trading in Canada.

Interactive Brokers has no minimum deposit requirement, and account management fees are determined by your account balance. For balances over $2,000, the fee is $10, and for balances below $2,000, the fee is $20. For traders 25 years old or younger, the fee is just $3.

Interactive Brokers offers both fixed and tiered pricing for many of its services. With tiered pricing, the fee per share decreases as trade volumes increase.

For margin accounts, you'll need a minimum deposit of $2,000. Market data subscriptions also have similar deposit requirements. Interactive Brokers also provides a robust stock research center and research tools, including APIs and a mobile app.

Before You Start Day Trading

Day trading should come with a warning label that the chance of success is low and the amount of risk associated with speculating on single businesses is very high. We recommend a lot of research before you get involved in day trading. For starters, here are two basic concepts you should consider familiarizing yourself with:

- Trading Volume: The stock trading volume represents how active a stock is or how often it changes hands. A high volume indicates greater interest in the stock and high liquidity and may indicate price fluctuations.

- Price Momentum: This strategy is used to find stocks with good price momentum; in other words, their price has gone up in recent days. As an investor, you would start looking for trading stocks with positive momentum.

As a day trader, you look for equities with high trading volumes and positive momentum. That is equities that are traded often (so you won't get stuck with them), and are increasing in trade value (at least in the very short term). It would be best to learn many strategies before starting, but now you have the best online brokerage platforms.

In Summary

Day trading platforms give investors the opportunity to lock in short-term profits before the trading day ends. They're designed to be fast and easy to use, but also powerful enough to make more complex trades so you can capitalize on market movements in real time.

After reviewing dozens of day trading platforms, we recommend Qtrade as the best broker for experienced investors. With zero minimums, access to over 150 stock exchanges worldwide, and a highly-rated app, I'm confident Qtrade is the best day trading platform in Canada today.

Day Trading Platforms FAQs

What do day traders usually trade?

The most often traded assets are foreign exchange (forex trading), stocks, bonds, cryptocurrencies, options, ETFs, and commodities available to day traders.

What is the difference between an online broker, a discount brokerage, and a trading platform?

There is no distinction between an online broker and a trading platform. There are no clear definitions for what those words mean, and they are frequently interchanged with a discount brokerage.

Should I use an online trading platform or a robo advisor?

When choosing between a trading platform and a robo advisor, the most important factor to consider is how much time and effort you want to put into your investing journey. If you want to be an extremely dedicated day trader, look for the trading platforms with the lowest fees.

For most people, we recommend the use of robo advisors.

If you're looking for a method to increase your money in a mathematically correct way, robo advisors' extremely simple index portfolios are your best bet. With its no-minimum starting investment, highly-rated app, low fees, and open access to financial advisors on-demand, Qtrade is currently Canada's best robo advisor and our top recommendation.

What Should I look out for in an online trading platform?

You should look at multiple trading platforms before deciding. There are four main criteria you should consider before choosing one of the trading platforms we listed:

- Commissions And Fees: First of all, you should look for the lowest – or even fee-free – trades. The lower the fees, the more of your gains you keep. A brokerage that offers low trading fees per share or tiered pricing for high-volume trades is the best option for most traders.

- Market Data And Research Tools: Choosing the platform is just half the battle. It would be best to look at the available market data and other trading platforms' trading tools. Most interactive brokers listed here do a great job bundling the data for a relatively low monthly fee – usually relatable.

- Asset Types And Products Available: The greatest brokerages for day trading provide a wide selection of financial instruments on the platform. All online brokerage platforms listed here let you trade stocks, ETFs, and options listed in Canada and the US (e.g., Qtrade). Some even offer free trades for ETFs and mutual funds (e.g., Wealthsimple Trade). Questrade and Interactive Brokers provide access to forex trading and CFDs if you're looking for more specific financial instruments.

Will my day trading gains be taxed?

Yes. All of your trading profits will be taxed in Canada. Because you trade as a day trader, your gains are unlikely to exceed the capital gain criteria so you won't receive any of the tax benefits.

If you sell a stock that has been held for less than a year, you will be taxed at the same rate as your ordinary income. Short-term gains from day trading are taxed higher than long-term investments.

Can you day trade in a TFSA?

Most Canadians should not use their RRSP or TFSA for day trading. The Canadian Revenue Agency (CRA) has spoken and stated that TFSAs are intended to be used for retirement savings, not for daily tax-free income.

The CRA might audit you if you frequently trade in your TFSA, and if you break the rules, your gains will be fully taxed.

Which account should you use to day trade?

It would be best to only trade in Canada using non-registered accounts or taxable accounts.