There are many ways to get your hands on Bitcoin (BTC), whether it's through the use of a cryptocurrency broker, a Bitcoin ATM, or even by mining it yourself. However, the easiest way for Singaporeans to buy and sell Bitcoin is through a cryptocurrency exchange operating in Singapore. Exchanges allow you to swap fiat currencies like the Singapore dollar (SGD) to cryptocurrencies like Bitcoin (BTC) easily and effectively.

Capital is my recommended exchange for Singaporean crypto investors, both for its high level of security and for its ease of use. Capital is also offering zero commission fees if you sign up using our referral link, so if you’re looking for a secure, cost-effective way to buy and sell crypto in Singapore, I can’t recommend Capital highly enough.

What Is Bitcoin?

Bitcoin (BTC) is a digital currency that allows users to send and receive money quickly without the need for any central authority or bank. The concept of Bitcoin was originally conceived by Satoshi Nakamoto, a pseudonymous person or group of people whose real-world identity has still not been revealed.

New Bitcoins are created whenever Bitcoin miners use extremely powerful computers to solve very complex mathematical problems in the Bitcoin network, and they get rewarded with Bitcoin as a result. This way of creating new crypto is known as proof of work, and it's called that way because miners are rewarded for the work they do in solving those problems.

Bitcoin has a fixed supply of 21 million total coins, which means there will never be more than 21 million Bitcoins in circulation. This makes Bitcoin a finite resource, like gold, which causes it to be deflationary in nature.

The smallest unit you can have for Bitcoin transactions is known as a Satoshi, which is worth one hundred millionth of one Bitcoin. Given that Bitcoin can be broken down into such small pieces, Bitcoin transactions can be even more precise than fiat (cash) transactions, making Bitcoin a great solution for the growing number of micro-transactions underpinning the web.

Pros & Cons Of Bitcoin

Bitcoin Pros

- Huge investment returns: Bitcoin's compounded annual growth rate has been around 144% per year from 2012 to 2022, outpacing any other asset class currently around. This means that investing in Bitcoin can lead to very high investment returns, depending on how its market fluctuates.

- Currency without borders: Considering Bitcoin can be sent across international borders without much issue, the overall flow of wealth becomes much simpler and less expensive.

- Decentralization: Bitcoin also doesn't have a third party to worry about, be it the government or a central bank, so it's difficult for any authority to have any power over the transactions that you conduct when using cryptocurrencies.

Bitcoin Cons

- Volatility: Bitcoin's potential for high investment returns is a double-edged sword. Cryptocurrencies in general are extremely volatile, and their price can vary wildly depending on how the market fluctuates, meaning that they're a very unpredictable investment vehicle.

- Lack of regulation: Bitcoin's partial lack of supervision by authorities means that you could lose your investments if you make a mistake or get scammed by someone else.

- Irreversible transactions: Even transactions made by mistake or fraudulently are irreversible whenever you deal with Bitcoin. A traditional banking system might be more beneficial in situations like these because you'd be able to reverse some transactions then.

Is Bitcoin Legal In Singapore?

Yes, digital payment tokens like Bitcoin (BTC) are legal to buy, sell, trade, and keep in Singapore. The Singaporean Government recognizes cryptocurrency's social and economic potential, but it also has its reservations, as it seeks to identify the risks involved with cryptocurrencies as well. Because of this, Singapore implements crypto-related AML regulations (which are outlined in Notice PSN02, issued by the Monetary Authority of Singapore (MAS)).

Additionally, cryptocurrencies are not considered legal tender in Singapore, which means that not all retailers are obligated to accept them as a form of payment and that they cannot be used to complete certain kinds of transactions (such as paying an electrical bill, for instance).

Is Bitcoin A Good Investment?

Despite Bitcoin's potential for high investment returns, it's hard to say with 100% certainty whether or not Bitcoin is a good investment. Cryptocurrency trading is risky in general, and you should always exercise caution whenever investing in crypto. Evaluating your risk tolerance is a must, as you can always lose a substantial amount of money whenever you deal with crypto.

However, considering crypto's substantial growth in the last couple of years compared to the stock market, it's easy to see why people choose to invest in crypto. All in all, crypto investments are highly dependent on the trader, and if you find crypto to go beyond your risk limit, it may not be an ideal investment vehicle for you altogether.

How To Buy Bitcoin In Singapore: 3 Steps To Follow

1. Look For A Cryptocurrency Exchange

Cryptocurrency exchanges are, by far, the easiest way for you to conduct cryptocurrency transactions in Singapore. A crypto exchange is a platform that will allow you to swap a fiat currency (such as Singapore dollars (SGD) or American dollars (USD)) for a cryptocurrency such as Bitcoin (BTC) or any other altcoin supported by the exchange itself (common examples include Ethereum (ETH), Dogecoin (DOGE), and SushiSwap (SUSHI)).

Although they're not as easy to use compared to a cryptocurrency broker, which serves as a mediator between crypto buyers and sellers, they almost always offer far lower fees compared to crypto brokers, which is important considering you could lose thousands of dollars to fees if the trades are large enough.

Crypto exchanges are also usually a better option compared to crypto mining, especially when you consider the electrical bills involved with crypto mining, as well as the fact that a mining rig can cost thousands of dollars to set up.

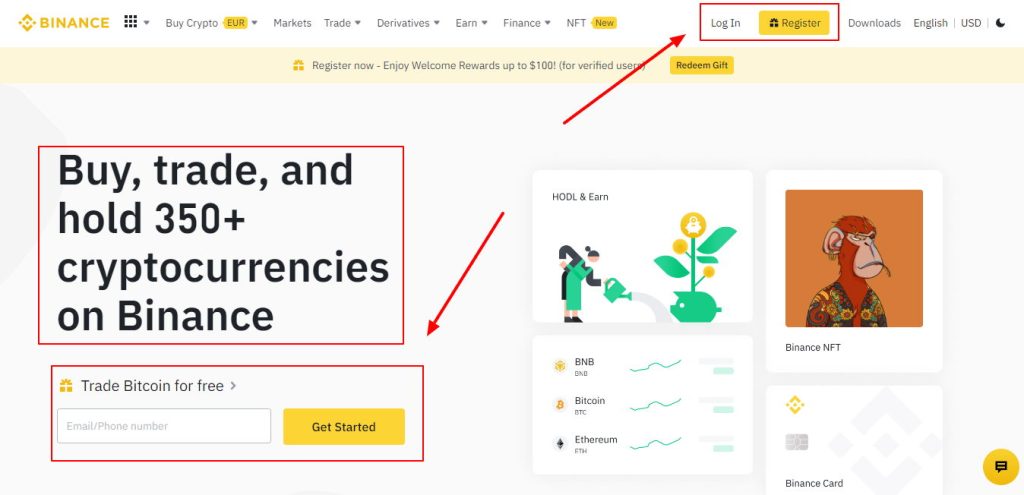

2. Create An Account In The Exchange You Chose

Creating an account in a crypto exchange tends to be pretty easy, but some crypto exchanges ask you to provide more information than others. In general, however, most ask for basic items such as your country of residence, your email, a password for your account, and your phone (often to set additional security measures such as 2-factor authentication, or 2FA).

Once you've provided this information to the exchange, you should be well on your way to buying Bitcoin and other cryptocurrencies in Singapore. However, don't be surprised if the exchange asks for additional information during the account verification process, as most crypto exchanges use a tiered account verification system. Common KYC requirements from crypto exchanges include:

- Full legal name.

- Date of birth.

- Address.

- Proof of address/phone jurisdiction.

- Description of source assets.

- Passport or other similar government-issued identification.

- Facial verification.

3. Buy Bitcoin

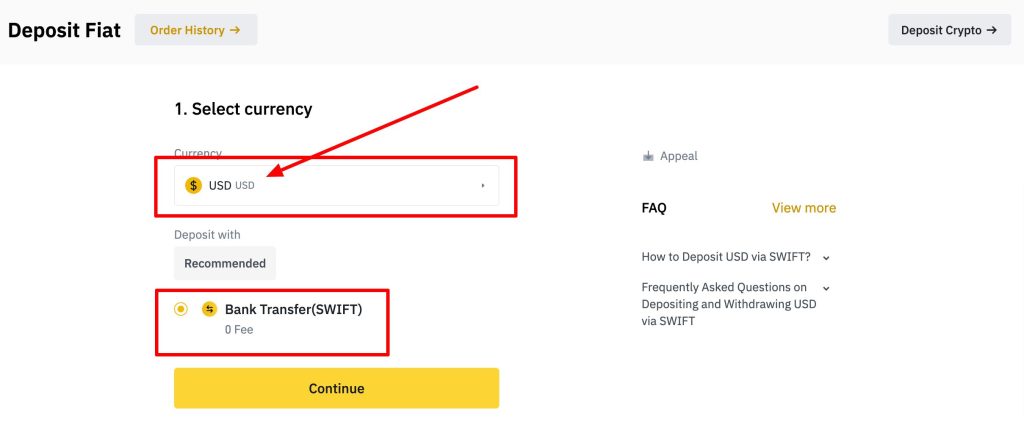

Once your account's fully verified and ready to go, then you've arrived at the step you've been waiting for all this time: buying Bitcoin through your preferred exchange. Depending on the exchange, this can be easier or harder to pull off, but overall, the exchange should have a Buy and Sell section which you'll be able to access from your dashboard once you've logged on to your account.

Once you've accessed said section, head to the “Buy” category, where you'll be able to choose the crypto coin you can buy. Fortunately, Bitcoin is the most widely recognizable crypto around today, so you'd be hard-pressed to find a crypto exchange that doesn't support Bitcoin in this day and age.

After clicking on the “Buy” button of the asset you chose (in this case, Bitcoin), the exchange will ask for the payment method you'll use to get your Bitcoins (one example being a bank transfer). Once you settle that, you'll acquire the Bitcoins and your balance should be updated in your crypto exchange account. Congratulations!

4. Store Your Bitcoins

Now that you own some Bitcoins, the next step is to find a safer place to store them. You can store cryptocurrency in your crypto exchange account, but that's generally an unsafe storage option, unless you're using one of the safest crypto exchanges in Singapore.

Whether you are or not, it's still a good idea to have a third-party crypto wallet. Bitcoin wallets protect your Bitcoin through a combination of public keys (which allow others to send you funds) and private keys (which allow you to send others funds). A cryptocurrency wallet can fall anywhere between three major categories:

- Paper wallets: This cryptocurrency wallet consists of writing down your private keys on a piece of paper and then storing them in a safe location. The advantage to these wallets is that they are free and relatively secure, but prone to loss of funds. If you lose that piece of paper, you're losing your Bitcoins as well.

- Software wallets: These crypto wallets consist of software that handles the storage of your crypto funds for you. Most of the time, these cryptocurrency wallets are free, but they are also prone to lacking key security features, depending on the software wallet you choose. Additionally, these wallets are not immune to being hacked, so they're not 100% guaranteed safety.

- Hardware wallets are physical crypto wallets that usually resemble a USB drive, only bigger in size. These crypto wallets are often regarded as the safest crypto wallet type and are highly secure, mainly because they store your cryptocurrencies offline and are therefore far away from the hands of hackers and thieves. However, one noticeable con regarding them is that they are very pricy, costing upwards of $50 to $200 to buy.

The Best Cryptocurrency Exchange In Singapore: Capital

Zero Fees

|

Trading fees: 0% |

★★★★★ Rated 4.9/5 |

Capital allows users to trade crypto alongside stocks, commodities, forex, market indices, ETFs and more—all without any trading fees. It supports 100+ cryptocurrencies, and users can trade with 2x leverage on crypto (up to 500x leverage on other assets).

Capital charges a tight spread ranging from 0.1% – 0.3% (depending on the asset), making the overall cost of using the platform (0% trading commissions + 0.1% – 0.3% spreads) very low. It has a fully functional desktop platform, a well-rated mobile app (4.7/5 on Android and iOS), and an excellent demo account where you can practice trading with real assets in real time.

Capital is licensed by the Australian Securities and Investments Commission (ASIC) and the Financial Conduct Authority (FCA) in the UK, which means it’s a safe, secure platform. Every user receives a dedicated account manager they can reach by email or phone anytime, which is part of the reason Capital’s customer support team receives such positive reviews.

Deposits and withdrawals are always free with Capital, and you’ll never pay trading commissions regardless of whether you place spot orders or limit orders. Capital is ISO 27001 certified for meeting robust information security standards, making it an extremely safe platform to trade with.

The biggest drawback of Capital is that it can take several days to have your account verified since their verifications team is overwhelmed with signups right now. If you sign up using my referral link, though, you can skip the waitlist and start trading immediately.

I’ve personally used Capital for more than 4 years, and based on my experiences and those of millions of other users, I can’t recommend it highly enough.

Features

- Zero trading commissions

- Tight spreads (0.1% – 0.3%)

- Supports 100+ cryptocurrencies

- Allows up to 500x leverage (2x leverage on crypto)

- Fully functional demo account for paper trading

- Free deposits and withdrawals via debit/credit cards, bank transfer, POLi, PayPal, Apple Pay, etc.

- Dedicated account manager you can reach at any time

- Excellent desktop trading platform

- Well-rated mobile app (4.7/5 on both Apple and Google)

- Licensed by the Australian Securities and Investments Commission (ASIC)

- ISO 27001-certified for meeting extremely high information security standards

Cost

- Trading fees: 0%

- Spreads: 0.1% – 0.3%

- Deposits & Withdrawals: Free

Signup Bonus

Skip the waitlist and have your account approved immediately by using my referral link below.

Best For

Investors looking for the best overall crypto trading experience with no trading commissions.

In Summary

There are many ways to get your hands on Bitcoin (BTC), whether it's through the use of a cryptocurrency broker or even by mining it yourself. However, the easiest way for Singaporeans to buy Bitcoin by far is through a cryptocurrency exchange. These platforms allow you to swap fiat currencies like the Singapore dollar (SGD) to cryptocurrencies like Bitcoin (BTC) easily and effectively.

Capital is my recommended exchange for Singaporean crypto investors, both for its high level of security and for its ease of use. Capital is also offering zero commission fees if you sign up using our referral link, so if you’re looking for a secure, cost-effective way to buy and sell crypto in Singapore, I can’t recommend Capital highly enough.

How To Buy Bitcoin In Singapore FAQs

Where Can I Buy Cryptocurrency In Singapore?

You can buy cryptocurrency in Singapore by using cryptocurrency exchanges or cryptocurrency brokers. Crypto exchanges are platforms that allow you to swap fiat currencies for crypto (and sometimes crypto for other cryptos), whereas crypto brokers are trading platforms where crypto buyers and sellers can gather around to make transactions.

In general, crypto exchanges are cheaper to use, which is why I recommend that you use crypto exchanges like Capital to buy Bitcoin in Singapore.

How Can I Buy Bitcoin In Singapore?

To buy Bitcoin in Singapore, you can use cryptocurrency exchanges or cryptocurrency brokers. I recommend using crypto exchanges like Capital to buy crypto like Bitcoin in Singapore, mainly because it's a highly secure platform that charges very competitive fees.

How Do You Invest In Cryptocurrency In Singapore?

There are many ways you can invest in cryptocurrency in Singapore: you could use a cryptocurrency broker to buy and sell crypto, use one of multiple Bitcoin ATMs across Singapore to buy Bitcoin, or even buy your own mining rig to mine the cryptocurrency yourself.

However, the easiest way of investing in cryptocurrency in Singapore is to use a crypto exchange like Capital to swap fiat currencies for crypto. Keep in mind that profits from crypto investing are taxable in Singapore.

How Do You Trade Cryptocurrency In Singapore?

To trade cryptocurrency in Singapore, you can use a cryptocurrency broker to buy and sell different crypto tokens, or you can use a crypto exchange to swap one crypto for another (or trade your crypto tokens with other users, if the crypto exchange supports that feature). I recommend using exchanges like Capital, since it takes security extremely seriously while offering zero commission trading if you sign up using our exclusive referral link.

What Is The Cheapest Way To Buy Bitcoin In Singapore?

The cheapest way to buy cryptocurrency in Singapore is to use a cryptocurrency exchange like Capital. Capital has an excellent reputation in the industry and takes security very seriously, an important factor when choosing who to invest your funds with.