Choosing the best crypto OTC broker isn’t easy, given how many options are out there and all of the different features each of them offers. As a long-time crypto investor myself, I constantly keep up with the latest and greatest crypto OTC brokers and make my recommendations below based on years of deep research and personal experience.

If you’re looking for an OTC broker that allows you to place cost-effective trades between $25,000 and $10+ million, you should be using Satstreet, the premium crypto OTC provider on the market today. Considering Satstreet's years-long reputation as being the #1 crypto OTC desk in Canada—plus its excellent, round-the-clock customer service—we can't recommend Satstreet highly enough.

What Is The Best Crypto OTC Brokers?

#1 Satstreet — Best Overall

If you’re trading between $25,000 and $10+ million, you should be using Satstreet. Satstreet is unlike the other exchanges on this list: it’s a white-glove trading experience for high-net-worth investors and corporations. They take a highly personalized approach to crypto investing, focusing their efforts on offering excellent service to a specific segment of the market.

Satstreet has extremely deep liquidity that allows it to offer fixed prices on large orders with zero slippage. Placing a $100,000 buy order is nearly impossible on most exchanges, but Satstreet handles orders that size (and much larger) every day.

Satstreet clients can choose to take custody immediately after a transaction, get access to an account with a qualified custodian, leverage their proprietary custody solution, or choose a multi-sig collaborative security setup involving multiple hardware wallets and co-signers. Satstreet also offers video verification on withdrawals and whitelisted wallet addresses, ensuring that only you can withdraw your funds.

With dedicated account managers available whenever you need them, Satstreet offers a level of customer service no other exchange can match. If you’re ready to invest $25,000 or more, Satstreet is for you.

Features

- Very low fees on large order volumes

- Very deep liquidity to prevent price slippage

- It supports both Bitcoin and Ethereum and allows access to the widest selection of crypto assets for accredited investors.

- Dedicated account managers provide top-notch support.

- Deep security expertise & customized security setups.

- Quick banking settlement (USD & CAD).

Pros & Cons Of Satstreet

Pros

- Competitive trading fees of 1%.

- Deep order books with great liquidity.

- Extremely quick account settlement.

- Grants every user a dedicated support rep.

- Has tight security standards.

- Has its own mobile app.

Cons

- Doesn't have pricing information readily available on its site.

- Not ideal for regular crypto trading.

Pricing

- Trading Fees: Around 1%.

Best For

Low fees and VIP treatment on large orders ($25,000 and up).

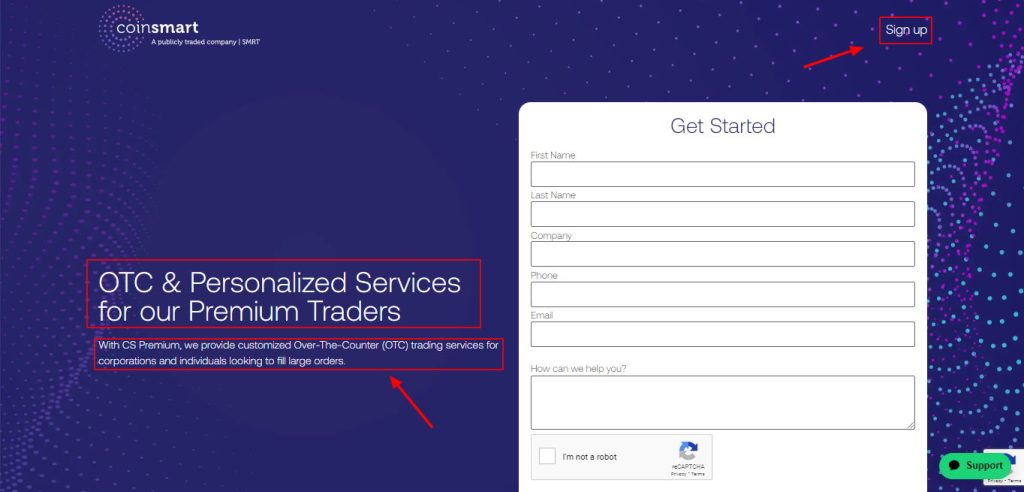

#2 CoinSmart Premium — Best For Beginners

CoinSmart Premium is a cryptocurrency over-the-counter (OTC) trading desk offered by CoinSmart, one of Canada's fastest-growing and most trusted crypto exchanges. CoinSmart was founded in 2018 and supports the most popular cryptocurrencies—including Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC)—making it one of the easiest ways to trade crypto.

CoinSmart Premium was designed specifically for crypto investors that are interested in making large crypto trades of at least $25,000 or more, and it has a few features to help them do so, such as their deep liquidity pools to prevent slippage on your transactions, exclusive market insights, a Dedicated CS Premium Account Manager, and much more.

Additionally, CoinSmart Premium offers a wide array of supported cryptocurrencies (at 300+ supported tokens in all), and allows you to trade one crypto for another directly. CoinSmart Premium uses Fireblocks for accepting coins as well as sending them out, which makes the trading experience smoother.

Features

- Its deeper liquidity pools are ideal for large crypto trades and transactions.

- Grants the user one-on-one assistance from a Dedicated CS Premium Account Manager.

- Quick KYC/AML verification.

- Supports a huge array of cryptocurrencies (300+).

- CoinSmart Premium is the only OTC desk in Canada or the United States that supports funding via online bill payment (up to $1 million without fees).

- Grants users VIP access to exclusive market insights.

- Publicly traded, licensed, and regulated by the Ontario Securities Commission (OSC).

Pricing

- Trading fees: Unlisted, but as close as possible to the spot rate

Best For

Institutions and high-net-worth individuals looking for the best overall crypto OTC desk.

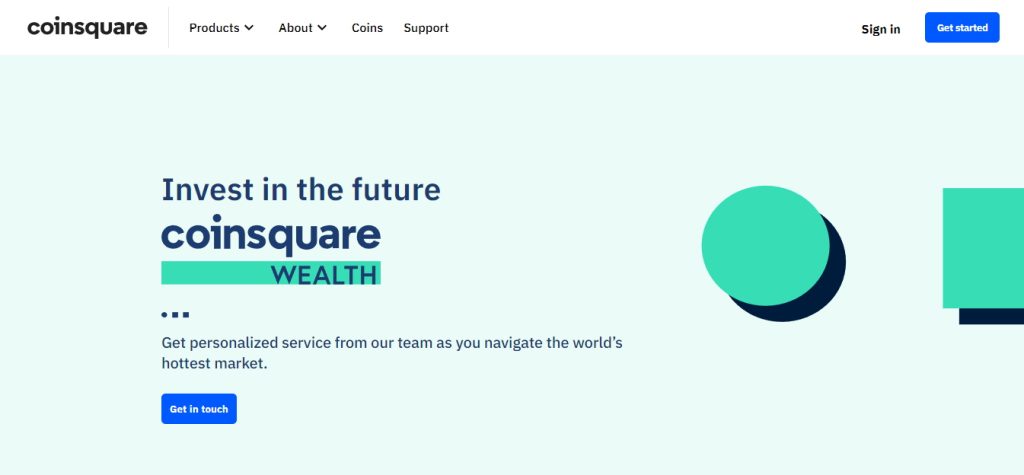

#3 Coinsquare Wealth — Best For Versatility

Coinsquare Wealth is a cryptocurrency OTC (over-the-counter) trading desk offered by Coinsquare, a crypto exchange originally founded in 2014. Coinsquare has had plenty of experience developing its platform to ensure it’s user-friendly and safe for traders, and Coinsquare’s team consists of talented individuals from all over the world who are passionate about cryptocurrencies. They pride themselves on their commitment to security and transparency.

Coinsquare Wealth will be useful for crypto traders looking to make large crypto trades of $50,000 or more per year. It has plenty of features to help them do so, such as enhanced liquidity from Coinsquare's internal markets and personalized service from a dedicated Wealth Director for every individual Coinsquare Wealth user. Additionally, this platform will allow you to make direct crypto-to-crypto trades between 40 crypto assets.

Features

- Has enhanced liquidity pools ideal for large crypto trades.

- Offers personalized service from a dedicated Wealth Director.

- Allows crypto-to-crypto trades between 40 assets.

- Has banking relationships with American and Canadian banks to allow for same-day settlements.

- Wealth Directors offer market insights so that you can conduct well-informed trading decisions.

- Supports 860 trading pair options.

- 24/7 customer support is available through live chat, email, and phone.

Pros & Cons Of Coinsquare Wealth

Pros

- Has enhanced liquidity pools that prevent slippage.

- Has extremely quick account settlement.

- Grants every user a Dedicated Wealth Investor.

- Has top-notch security standards similar to its main crypto exchange service.

- Allows crypto-to-crypto trades for added comfort.

- Supports an astounding 860 trading pairs.

Cons

- The platform can only be used if you meet one of two criteria (you either need a trading volume $50,000 or more per year or have assets greater than or equal to $500,000).

- The platform doesn't have its pricing information readily available, and you'll need to consult it directly to get it.

Pricing

- Trading fees: 0.25% to 1% (Depending on the size of the transaction).

Best For

OTC crypto traders looking for a platform with a wide array of supported trading pairs.

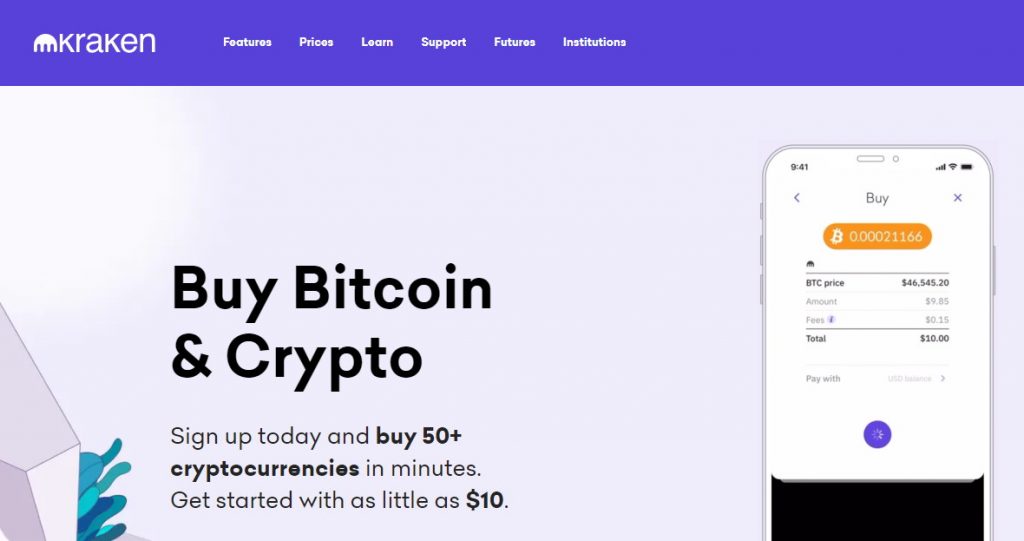

#4 Kraken OTC — Best For Commission-Free Trading

Kraken is a cryptocurrency exchange and bank originally founded in 2011. It’s located in the United States (specifically San Francisco) and lets you trade fiat currencies like USD for cryptocurrencies and vice-versa. However, the platform also has a crypto OTC service that it launched back in 2018, and this OTC desk will benefit crypto investors looking to conduct large trades the most.

This crypto OTC desk supports over 45 different tokens, and it also accepts a wide variety of fiat currencies (such as USD, EUR, CAD, GBP, CHF, and many more). Additionally, the platform supports commission-free trading, and you'll also have a 1-on-1 service to help you every step of the way. Considering you'll also have access to expert market insight at your fingertips and 24/7 global coverage, this makes Kraken one of the best OTC services if you're looking to trade large amounts of crypto.

Features

- Expert market insight from members that have previously worked at major financial institutions (such as JP Morgan and UBS).

- 1-on-1 service that will answer every question you could have about using the platform.

- A wide array of supported crypto assets (45+).

- A wide array of supported fiat currencies (7).

- It can be used anywhere globally, 24/7.

- Supports commission-free trading.

- It has deep liquidity pools that prevent slippage.

Pros & Cons Of Kraken

Pros

- Its liquidity pools prevent slippage, saving you money in the long term.

- You don't have to pay any fees using this platform.

- Has 24/7 customer support through live chat, email, and phone.

- The platform's expert market insights allow you to make better crypto investments.

- Supports crypto-to-crypto trading.

- It has strong security standards similar to the main platform.

Cons

- It has a high minimum order size ($100,000).

- Kraken is based in the U.S., meaning that users must comply with the strict regulations of the IRS.

Pricing

- Trading fees: None.

Best For

High-net-worth crypto traders looking for a commission-free OTC desk.

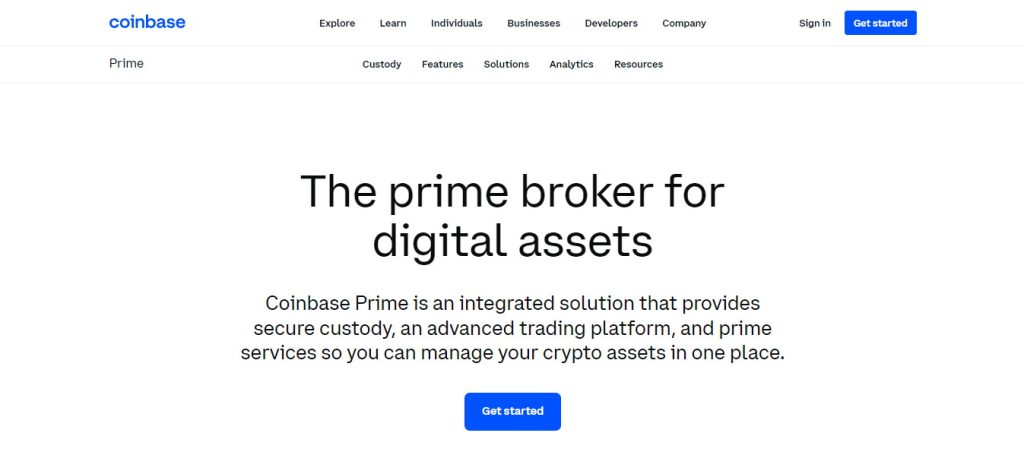

#5 Coinbase Prime — Best For Security

Coinbase is an American cryptocurrency exchange that was originally founded in 2012. It’s based in San Francisco, and it’s one of the oldest cryptocurrency exchanges in the world: it was designed to be one of the easiest places to buy, sell, and trade cryptocurrency, and it serves retail investors, businesses, and institutions alike. Originally, it only supported Bitcoin, but it now supports a wider array of digital assets.

Coinbase's dedicated subsidiary service, Coinbase Prime, grants users access to features such as a diversified liquidity pool, OTC block trading, margin finance, high-touch 24/7 support with market commentary included, execution algorithms, and much more. It also has an easy-to-use interface that is also very secure, and it even has a mobile app that allows you to review and trade transactions on the go, which is not a very common sight as far as crypto OTC desks are concerned.

Features

- It offers a diversified liquidity pool that prevents slippage.

- It has smart order routing algorithms that send your orders to the supported exchange with the best all-in prices.

- Has its own mobile app.

- It has highly responsive 1-on-1 customer support, available 24/7.

- It has a cold storage policy to keep your crypto funds safe.

- Supports crypto staking.

- It has thorough post-trade reporting analytics that you can access at any time.

Pros & Cons Of Coinbase Prime

Pros

- It grants users access to both real-time and historical analytics for cryptocurrency spot and derivatives markets.

- Allows users to trade on the go with its intuitive mobile app.

- The platform's algorithms optimize your trading based on your trade execution goals.

- Crypto staking allows you to earn passive crypto income.

- 1-on-1 customer support will be ready to answer any of your questions immediately.

- Has its own portfolio tracker for each cryptocurrency and crypto investment prospect.

Cons

- It doesn't have its pricing schedule information readily available on its site, and users will have to upgrade to Coinbase Prime to find out their schedule.

- It was originally designed for institutions, meaning that it has high minimum order sizes.

Pricing

- Trading fees: Differs from user to user.

Best For

Institutional investors looking for a highly secure OTC desk.

#6 Binance OTC — Best For Retail Traders

Binance is an international cryptocurrency exchange and the world’s largest crypto exchange by volume. Headquartered in the Cayman Islands, Binance began operations in 2017: the platform was originally founded in Hong Kong but has relocated its headquarters to the Cayman Islands due to increasing intervention in cryptocurrencies coming from the Chinese government.

One thing that characterizes Binance's OTC desk is its huge array of supported crypto tokens, which is nearly as big as the retail exchange's token list. You'll be able to trade between these crypto tokens as well, and you'll be able to quickly create and settle an account without any 3rd party involvement, which increases security. Considering the platform also has a low minimum order size of $10,000, even retail crypto traders will be able to get into OTC trading with Binance OTC.

Features

- Personalized service for every user, with assistance every step of the way.

- A huge array of supported cryptocurrencies (300+).

- Supports crypto-to-crypto trading.

- Fast account settlement that finishes within minutes.

- Trades can be confirmed within minutes.

- Reduced counterparty risk, as you only send coins to your Binance account.

- Beginner-friendly.

Pros & Cons Of Binance OTC

Pros

- A low minimum order size allows more users to get into crypto OTC trading.

- Fast account settlements allow you to trade OTC right away.

- Easy to use.

- Personalized service grants answers to any questions you could have regarding the platform's usage.

- Its huge array of crypto assets allows you to greatly diversify your crypto portfolio.

- Has a deep liquidity pool, particularly in the altcoin markets (even for altcoins with a low market cap).

Cons

- The American version of the platform (Binance.US) is limited to 12 coins.

- The platform is not ideal for buying smaller amounts of cryptocurrency.

Pricing

- Trading fees: None.

Best For

Retail crypto traders looking for an OTC desk with a low minimum order size.

#7 Bitfinex OTC — Best For Complex Trading

Bitfinex is a cryptocurrency exchange headquartered in the British Virgin Islands that was originally founded in 2012, making it one of the oldest crypto exchanges currently around. The platform is closely associated with Tether (USDT), as they have both their management and many shareholders in common. However, this has given the exchange quite a list of issues with regulators in the past.

Bitfinex also has a decentralized OTC desk that allows you to trade ERC-20 tokens: it has very low fees of 0.1% per transaction, which is very competitive. However, it's worth pointing out that this platform is peer-to-peer, meaning that you'd have to search for buyers yourself or look for a third-party broker that'd be willing to help you find buyers.

Features

- Deep liquidity pools.

- Order types on the main platform are also supported on the OTC desk.

- Solid security measures.

- A very wide array of supported cryptocurrencies (270).

- Low OTC trading fees of 0.1%.

- Paper trading feature for beginners to learn to use the platform.

- It has a Bug Bounty Program that will reward you for spotting bugs and security vulnerabilities on the platform.

Pros & Cons Of Bitfinex

Pros

- It has many supported order types (including stop, stop-limit, trailing stop, fill or kill (FOK), and many more).

- Its low fees will save you money on your crypto investments.

- Beginner-friendly, thanks to its paper trading feature.

- Its wide array of supported tokens allows you to diversify your portfolio considerably.

- Its deep liquidity pools prevent any slippage from happening.

- Has a mobile app.

Cons

- Not available to Canadian users in Ontario.

- The main trading platform has a history of fines and issues with regulatory entities.

Pricing

- Trading fees: 0.1%.

Best For

OTC traders looking for an OTC desk with a plethora of order types.

What Are Crypto OTC Brokers?

Over-The-Counter (OTC) Trading is a private trading market for buying and selling crypto that enables users to trade outside of a regular crypto exchange. OTC trades only happen whenever the buyer and the seller agree on a price for the amount being traded, and these trades can be either crypto-to-crypto or fiat-to-crypto.

Therefore, crypto OTC brokers (also known as Bitcoin OTC brokers) are merely platforms where buyers and sellers can conduct their transactions securely and without destabilizing the order book with the large amounts of cryptocurrency they are trading.

Benefits Of Crypto OTC Brokers

There are a few major benefits of using Crypto OTC Brokers:

- Because OTC brokers specialize in large crypto trades, these platforms have enhanced liquidity when compared to their crypto exchange counterparts, allowing for large transactions that can be executed quickly and without issues.

- OTC desks also have enhanced confidentiality, as only the buyer and the seller know what's happening in the transaction.

- Only direct transactions ever happen in OTC desks, which means that scams coming from third parties are non-existent.

- Considering not many people trade over the counter, these platforms can dedicate more time to providing state-of-the-art customer support, which is often personalized to cater to the user's needs.

In Summary

Choosing the best crypto OTC broker isn’t easy, given how many options are out there and all of the different features each of them offers. As a long-time crypto investor myself, I constantly keep up with the latest and greatest crypto OTC brokers and make my recommendations below based on years of deep research and personal experience.

If you’re looking for an OTC broker that allows you to place cost-effective trades between $25,000 and $10+ million, you should be using Satstreet, the premium crypto OTC provider on the market today. Considering Satstreet's years-long reputation as being the #1 crypto OTC desk in Canada—plus its excellent, round-the-clock customer service—we can't recommend Satstreet highly enough.

Best Crypto OTC Brokers FAQs

How Much Do Crypto OTC Brokers Cost?

A Crypto OTC Broker can have fees anywhere between 0.1% to 1% per trade. However, some crypto OTC brokers have commission-free trading, meaning that using their services is completely free.

What Is The Cheapest Crypto OTC Broker?

The cheapest Crypto OTC Broker is Satstreet. The main exchange offers commission-free trading, and using its OTC desk will also avoid incurring any fees.

What Is The Best Free Crypto OTC Broker?

The best free Crypto OTC broker is Satstreet. It has zero fees to worry about, deep liquidity pools, and personalized one-on-one customer support & guidance.

Are Crypto OTC Brokers Worth It?

Yes, using a crypto OTC broker is worth it because they provide a safe environment to conduct large crypto trades. They also add further comfort by supporting crypto-to-crypto trading, which is a feature that even some retail crypto exchanges lack.

Are Crypto OTC Brokers Safe?

Yes, trading with crypto OTC brokers is safe because they have the same security features that retail crypto exchanges have. They also offer cold storage, which prevents hackers from even coming close to your funds.

Are Crypto OTC Brokers Legit?

Yes, crypto OTC brokers are legit because they are regulated in the same way that crypto exchanges are. This means that they fully comply with laws imposed on cryptocurrencies, which prevent these platforms from engaging in money laundering and terrorist financing activities.

Do all crypto exchanges offer an OTC exchange?

No, not all crypto exchanges offer an OTC (Over-the-Counter) exchange. OTC exchanges are typically designed for institutional or high-volume traders who need to buy or sell large amounts of cryptocurrency without affecting the market price. While some exchanges like CoinSmart, VirgoCX and Newton all offer that option, others like Wealthsimple Crypto and Shakepay do not.