With a welcome bonus of up to 15,000 MR points, a 5X earn rate on eligible eats & drinks (including spending on groceries, food delivery, cafes, bars and more), and a monthly fee of just $12.99, I strongly believe the American Express Cobalt Card is the best all-around card for most Canadians.

If you like to travel but don't want to break the bank while you do it, the Cobalt Card is ideal for you; with generous rewards that can be converted into flights and a $100 USD annual hotel credit, travelers can't go wrong with this card. The 15,000 MR points aren't likely to be around for long, though, so I recommend taking advantage of this limited-time offer before it disappears.

To put it plainly, the American Express Cobalt Card makes an extremely compelling offer. $12.99/month for a card that gets you 5X the points on food and drink purchases in Canada and 2X the points on gas, transit & ride share purchases is an excellent deal.

But of course, as we’ve come to expect from other American Express cards through their other offers—like the Platinum Card and the Business Platinum Card—there’s much more to the Cobalt than meets the eye. Once you learn the ins and outs of this card, I’ll be surprised if you aren’t applying for one of your own by the end of this post.

What Is The American Express Cobalt Card?

The American Express Cobalt Card is a low-fee, high-reward credit card primarily marketed toward millennials and near-millennials. It was first released in 2017, and since that time has become one of the most popular cards in all of Canada.

Amex Cobalt Pros & Cons

Pros

- Monthly fee of just $12.99, with no annual fees

- Up to 15,000 MR welcome bonus points for using your card every month

- $100 USD in hotel credit annually

- One of the best and most flexible points earn rates of any credit card in Canada

- Points are easy to use

- Up to 9 additional Cobalt Cards for free

- Cobalt Cardmembers receive regular Perks such as bonus reward offers and access to great events

Cons

- $30,000 cap on the 5X earn rate (equivalent to 150,000 MR)

Amex Cobalt Features & Benefits

| Welcome Bonus | 1,250 MR points every month you charge at least $750 to the card |

| Travel Benefits | • $100 USD hotel credit for spa, restaurants and other amenities at The Hotel Collection participating properties • Complimentary room upgrades at The Hotel Collection participating properties |

| Monthly Fee | $12.99 |

| Additional Card Fee | Up to 9 free additional cards |

| Points Earned Per $1 Spent | • 5X on eligible eats and drinks, including groceries and food delivery • 2X on eligible gas, transit & ride share • 1X on everything else |

| Travel Coverage | • $5,000,000 Emergency Medical Insurance (out of province/country) • $250,000 Travel Accident Insurance • Flight Delay Insurance • Baggage Delay Insurance • Lost or Stolen Baggage Insurance • Hotel/Motel Burglary Insurance • Car Rental Theft and Damage Insurance |

| Purchase Coverage | • Buyer’s Assurance Protection Plan • Purchase Protection Plan |

| Eligibility | • Canadian citizens or residents • A valid Canadian Credit file • An account in good standing (recommended credit score of at least 650) |

| Type of Card | Credit card |

What Are Membership Rewards Points And How Much Are They Worth?

The value of any loyalty program's points depends on how you use them. With this in mind, American Express has always offered a lot of flexibility regarding what you can do with your Membership Rewards points, increasing their value and making them more attractive overall.

I recommend using your American Express points only on flights, since you can get some exceptional deals that way. Here are just a few options available to you:

| Origin & Destination | Points Required | Taxes & Fees |

| Roundtrip Toronto to Hong Kong | 70,000 | $100 |

| Roundtrip Vancouver to Hong Kong | 60,000 | $90 |

| Round-the-world: Toronto → Hong Kong → Dubai → London → Toronto | 74,500 | $761 |

| Round-the-world: Vancouver → Hong Kong → Dubai → London → Vancouver | 74,700 | $742 |

How To Earn Bonus Points With Your Cobalt Card

Most American Express cards—including its suite of business cards—come with a single welcome bonus that you get once you reach a minimum amount charged to the card. The same principle applies to the Amex Cobalt, only on a monthly basis: if you manage to get the 12 bonuses, you'll amass a total of 15,000 bonus points by the end of the year.

At the lowest possible value of 1 cent per MR point, this bonus adds up to $300 for a card that costs $155.88. If you assume a more reasonable value up to 2-3 cents per MR point, you'll earn back $600-$900 on the points alone (not to mention the additional points you'll earn by spending money on the card each month).

Amex Cobalt Earn Rate

American Express Cobalt Cardholders have three unique earn rates depending on what they buy:

- 5X the points on food & drinks (with a cap at $30,000 per year)

- 2X the points on eligible gas, transit & ride share purchases

- 1X the points on all other purchases

The 5X earn rate (5 points earned for every $1 spent) on eligible food and drink purchases is the highest earn rate offered on any credit card in Canada. And in case you're wondering what American Express classifies as food and drinks, here it is:

Restaurant, quick service restaurant, coffee shop and drinking establishments in Canada, stand-alone grocery stores in Canada, delivery of food and groceries in Canada…

This is extremely flexible, and it's exactly what makes the American Express Cobalt Card the best everyday spending card available in Canada today.

How To Save 10% On Your Spending With The American Express Cobalt

If you apply for the American Express Cobalt Card today, you’ll receive 1,250 MR points for every month that you charge $750 to the card in the first year.

On top of that, you also earn 5X points for every dollar you spend on food and drinks. And when you do, you’ll save 10% on that month’s spending. Here’s the math that explains what I mean:

1,250 bonus points for spending $750/month

+ 1,250 points (5X points on $750 spent on food/drinks)

= 2,500 points earned per month

When you apply those points at the lowest possible value of 1 cent per point, you get $25 back on your $750 of spending. That's a minimum savings of 5%!

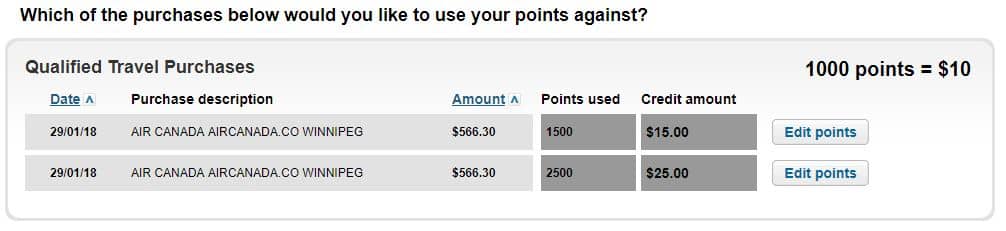

Here’s how it looked when I applied 4,000 MR points against two flights I’d recently redeemed my MR points for with Aeroplan:

Of course, it’s not a problem if you don’t spend $750 per month on food and drinks. Let’s imagine that one month you spend $300 on food and drinks and the other $200 on something else:

1,250 bonus points for spending $750/month

+ 1,500 points (5x points on $300 spent on food/drinks)

+ 200 points (1X points on $200 spent on other items)

= 2,950 points earned per month

That's still a minimum savings of 6%—not too shabby, if you ask me.

Travel Coverage On The Cobalt Card

Insurance coverage is important to most travelers, so you'll be pleased to know that the Cobalt Card delivers a comprehensive set of insurance policies, especially given how inexpensive the card is.

Here are the travel-related insurance policies that come with the Cobalt Card:

- $5,000,000 Emergency Medical Insurance (Out of province/country): This policy covers virtually any accident that needs medical attention while you're abroad, and covers you, your spouse and dependent children—plus additional cardmembers and their spouse and dependent children—for any number of trips with a maximum duration of 15 days.

- $250,000 Travel Accident Insurance: This is an AD&D life insurance policy that covers you and your family while you're traveling.

- Flight Delay & Baggage Delay Insurance: These are two separate policies that will cover any unforeseen expenses due to your flight or baggage being delayed. It includes out-of-pocket money, food, and hotel stays up to $500.

- Lost or Stolen Baggage Insurance: This policy recovers up to $500 in lost or stolen items.

- Hotel/Motel Burglary Insurance: Up to $500.

- Car Rental Theft and Damage Insurance: Waive the vehicle rental company's insurance policy and get up to $85,000 of coverage for free.

Amex Cobalt Purchase Coverage

When it comes to purchase coverage, the Amex Cobalt comes with American Express' two standard policies:

- The Buyer’s Assurance Protection Plan, which doubles the manufacturer’s warranty for up to one extra year on any purchase paid in full with your American Express Cobalt Card.

- The Purchase Protection Plan, which covers your Cobalt Card purchases against accidental damage and theft up to a maximum of $1,000.

Free Supplementary Cobalt Cards

Giving your family members (or employees) supplementary cards is a great way to earn more points. The Cobalt Card doesn't charge any fee for supplementary cards, unlike some other credit cards.

You can request up to 9 additional Cobalt Cards for supplementary cardholders free of charge. Supplementary cardholders must be at least 13 years of age.

In Summary

With a welcome bonus of up to 15,000 MR points, a 5X earn rate on eligible eats & drinks (including spending on groceries, food delivery, cafes, bars and more), and a monthly fee of just $12.99, I strongly believe the American Express Cobalt Card is the best all-around card for most Canadians.

If you like to travel but don't like to break the bank while you do it, the Cobalt Card is a great option; with generous rewards that can be converted into flights and a $100 USD annual hotel credit, travelers can't go wrong with this card. The 15,000 MR points isn't likely to be around for long, though, so I recommend taking advantage of this limited-time offer before it disappears.

American Express Cobalt FAQs

Is the American Express Cobalt Card hard to get?

No, the Amex Cobalt is not hard to get because it does not have a specific income requirement. American Express will still check your credit score, though, with a credit score of at least 600 being recommended to be approved for the Amex Cobalt Card.

What is the Amex Cobalt good for?

The Amex Cobalt is the best credit card in Canada for earning rewards: with 5x the rewards on restaurant, bar and grocery store spending, the Cobalt Card offers a great way to earn points, which can then be converted into Aeroplan Miles that can be used for domestic or international flights.

Is the Amex Cobalt metal?

No, the Amex Cobalt is not made of metal: it’s made of plastic, and the current model weighs 5 grams. In that sense, it's similar to the Amex Gold Rewards Card. The only American Express cards made of metal in Canada are the Platinum Card and the Centurion (Black) Card, which accepts new cardholders by invitation only.

How do you qualify for the American Express Cobalt Card?

To qualify for the Cobalt Card, you’ll need a credit score of around 600 – 650, which is considered “fair” in Canada. If you have a credit score above that range, you should have no problem being approved for the Cobalt Card.

The easiest way to know if you'll be approved is to apply. The link above gets you a 15,000 MR points signup bonus.

What is the limit on the Amex Cobalt Card?

The limit on your Amex Cobalt Card will depend on how much credit American Express is willing to extend to you, and will vary from person to person. My Cobalt Card currently has an $8,000 limit, though yours may be more or less depending on your credit history, your history with American Express, and other factors.

Is the Amex Cobalt instant approval?

Yes, most applicants will be approved for an Amex Cobalt Card instantly. Some applicants even receive their credit card number immediately, allowing them to start using the card right away.

Is the Amex Cobalt a credit card or a charge card?

The Amex Cobalt Card is a credit card. Unlike a charge card, where you are required to pay off your balance each month, the Cobalt Card allows you to carry a balance and pay it off over a period of time if you wish.

Does the Amex Cobalt give you airport lounge access?

Yes, Amex Cobalt Cardholders get a Priority Pass membership (though no free lounge passes are included) and 4 free passes to Plaza Premium Lounges in Canada.

Do Amex Cobalt points expire?

Amex Cobalt points (officially known as American Express Membership Rewards points) have no expiration date, so you can keep them in your account for as long as you like. The only reason you'll lose your Amex Cobalt points is if they're removed from your account due to a breach in your account’s Terms and Conditions.

How do I maximize my Amex Cobalt?

To take advantage of the American Express Cobalt Card, you should make sure to do a few things:

- Ensure you hit the $750 spending threshold during each of the first 12 months to receive the maximum welcome bonus of 15,000 points

- Move all of your food & drink spending onto the Cobalt Card, including spending at restaurants, bars, cafes, grocery stores, and food delivery apps like Uber Eats

- Plan how you'll use your $100 USD annual hotel credit

Can an Amex Platinum Cardholder refer someone to an Amex Cobalt?

No, Amex Platinum Cardholders cannot refer others to an Amex Cobalt Card. To refer someone to an American Express card, you need to hold the same card as the one they're applying for.

To get the highest available signup bonus on your Cobalt Card, use my referral link above.

Is The Amex Cobalt Card worth it?

Yes, the the American Express Cobalt Card is worth the price, and I believe it's one of the best credit cards in Canada. With its impressive 15,000 points welcome bonus, $100 USD annual hotel credit, complimentary hotel room upgrades, comprehensive travel insurance, and best-in-class earn rates, you truly can't go wrong with a Cobalt Card.